Advertisement|Remove ads.

MP Materials, USA Rare Earth Draw Heavy Retail Buzz After China Halts Exports Of Critical Minerals

MP Materials (MP), The Metals Company (TMC), and USA Rare Earth (USAR) stocks garnered significant retail attention on Monday following news that China is halting the exports of critical minerals in the ongoing trade war with the United States.

USA Rare Earth and MP Materials were among the top trending symbols on Stocktwits as of 3:00 am ET on Tuesday.

MP Materials rose 7% in extended trading after jumping more than 21% on Monday, while USA Rare Earth surged 41.4% during the regular trading hours.

Rare earth minerals and magnets are used in various industries, from electronic vehicles to mobile phones.

According to a report by The New York Times, Beijing ordered restrictions on exporting six heavy rare earth metals, which are refined entirely in China, on April 4. The government also put curbs on rare earth magnets, 90% of which are produced in China.

The report said that the shipments have been halted as China is drafting a new system to regulate the exports of critical minerals, and it could prevent supplies from reaching certain companies, including American military contractors.

The Donald Trump administration is reportedly looking to counter this by preparing an executive order to stockpile rare earth minerals from the deep sea.

MP Materials, which produces cerium, lanthanum, and neodymium, also has refining operations in China. However, the top rare earth minerals-producing U.S. company is rapidly expanding its domestic refining operations.

USA Rare Earth is currently building a rare earth magnet-making facility in Stillwater, Oklahoma, and has mining rights at several places in the U.S.

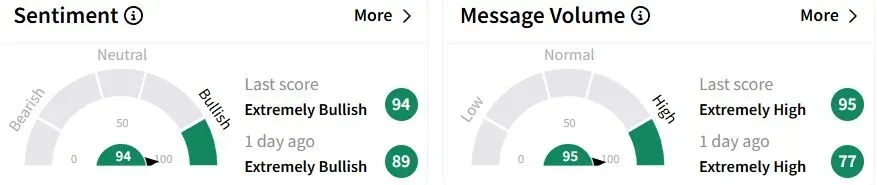

Retail sentiment on Stocktwits about USA Rare Earth remained ‘extremely bullish’ (95/100), while retail chatter was ‘extremely high.’

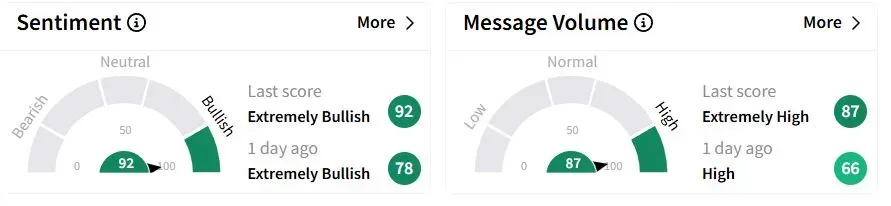

Meanwhile, sentiment about MP Materials was also ‘extremely bullish’ (92/100), and chatter rose to ‘extremely high.’

One retail investor said there is a growing speculation that The Metals Company, which has permits for deep sea mining, could partner with MP Materials to process the minerals.

Another trader asked others not to sell the stocks, as China will likely continue using rare earth metals in the trade war with the U.S.

MP Materials shares have gained 74%, and USA Rare Earth shares are down 15.3% year-to-date (YTD).

Also See: China's Port Activity Slows Sharply As Trump Tariff War Escalates

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_rig_bfbf070c8b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1473343393_1_jpg_536dff4c41.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247675651_jpg_f78879cce2.webp)