Advertisement|Remove ads.

MRVL Stock Slumps After Celestial AI Acquisition — What Does The Street Think?

- Rosenblatt lowered its price target on Marvell to $115 from $120, while maintaining a ‘Buy’ rating on the shares.

- The analyst said that it was reducing its FY27 and FY28 non-GAAP EPS estimates based on management's cost and revenue estimates on completion of Celestial AI’s acquisition.

- UBS cut the price target on Marvell to $115 from $120 and kept a ‘Buy’ rating on the shares.

Marvell Technology Inc. (MRVL) shares declined over 5% on Tuesday, shortly after the company announced the completion of its acquisition of Celestial AI on Feb. 2.

The semiconductor company drew attention from Wall Street after announcing details of the acquisition. Analysts Rosenblatt, Citi, and UBS cut price targets on the company to adjust for the deal’s impact, according to TheFly.

Street Consensus

Rosenblatt lowered its price target on Marvell to $115 from $120, while maintaining a ‘Buy’ rating on the shares. The analyst said that it was reducing its FY27 and FY28 non-GAAP EPS estimates based on management's cost and revenue estimates on the completion of Celestial AI’s acquisition.

UBS cut the price target on Marvell to $115 from $120 and kept a ‘Buy’ rating on the shares. The firm said that it trimmed its estimates on the company to account for near-term dilution from the deal.

Meanwhile, Citi also cut its price target on Marvell to $113 from $114, while maintaining a ‘Buy’ rating on the shares.

Acquisition Details

In December, Marvell announced its agreement to acquire Celestial AI for about $3.25 billion in a cash-and-stock deal. On Tuesday, the company announced that it had completed the transaction.

Celestial AI’s technologies and teams would become a part of Marvell’s Data Center Group, the company said. The deal would further strengthen its position across next-generation AI and cloud data center architectures as Celestial AI’s capabilities would expand Marvell’s optical connectivity, boosting more integrated, high-bandwidth, and power-efficient solutions for its data center customers, it added.

Meanwhile, the Santa Clara-based company said that it expects initial revenue contributions from the acquisition to start in the second half of fiscal 2028, and for revenue to ramp up to a $500 million annualized run rate in the fourth quarter. The company expects revenue to double to $1 billion, on an annualized run rate, by the fourth quarter of fiscal 2029.

However, the deal would increase the company’s operating expenses by about $50 million. The acquisition also set back Marvell by $1 billion in cash, and would lower the company’s Other Income by about $38 million on an annual basis, it said. Marvell also noted that the deal would result in equity dilution.

How Did Stocktwits Users React?

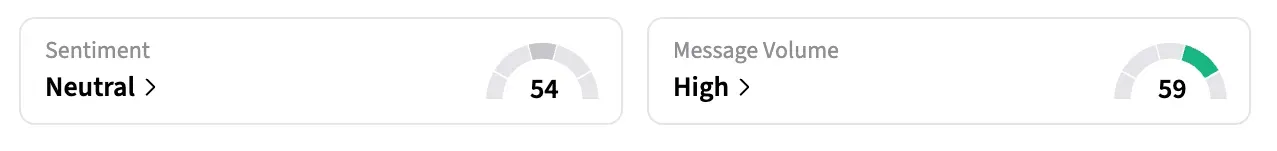

On Stocktwits, retail sentiment around MRVL shares climbed from ‘bearish’ to ‘neutral’ territory over the past 24 hours, amid ‘high’ message volumes.

One bullish user, however, called the company one of the most undervalued AI chip stocks, adding that they won’t be surprised if it jumps to over $200. Shares of MRVL were trading around $74.58 at the time of writing.

Another bullish user noted how Marvell’s custom AI processors are used by four of the top hyperscalers in the U.S., and also pointed to the company’s earnings projections, saying it was a ‘no-brainer’ to buy the stock.

Shares of MRVL have lost over 34% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: ZENA Stock Gained In Pre-Market Today – What Is The New DaaS Deal About?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)