Advertisement|Remove ads.

Bitcoin Jump Boosts MicroStrategy, Marathon, Riot Stocks Pre-Market: Retail Flocks To Trending Tickers

Shares of crypto-linked stocks MicroStrategy, Inc., Marathon Digital Holdings, Inc., and Riot Blockchain, Inc. rose more than 3% in pre-market trading on Monday as Bitcoin surged over 7% to $64,927, reaching its highest level in two weeks as of 7:45 a.m. ET.

An analyst quoted by Bloomberg suggested that markets may have interpreted disappointing China stimulus news as positive for Bitcoin, possibly due to capital rotation from Bitcoin into Chinese equities previously weighing on crypto prices.

Meanwhile, Chinese stocks on Monday had a mixed reaction to weekend promises of further stimulus without a clear spending target.

Bloomberg also reported that the U.S. presidential race could be another factor lifting digital assets, with prediction markets recently flipping to assign pro-crypto candidate Donald Trump higher odds of victory over Vice President Kamala Harris.

MSTR, MARA, and RIOT were the top three trending stocks on Stocktwits early Monday before the market opened.

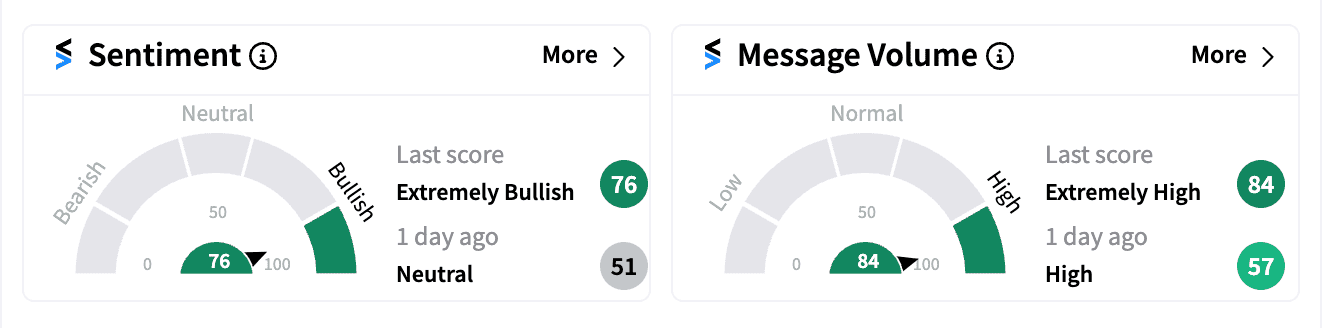

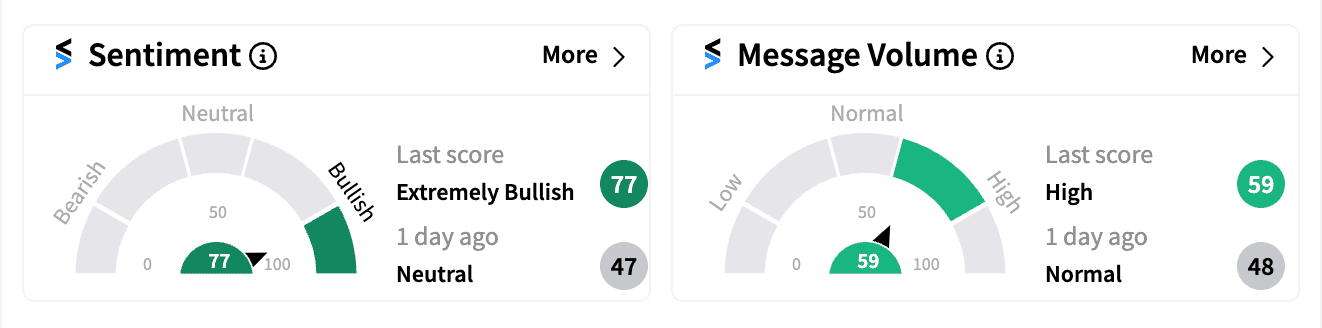

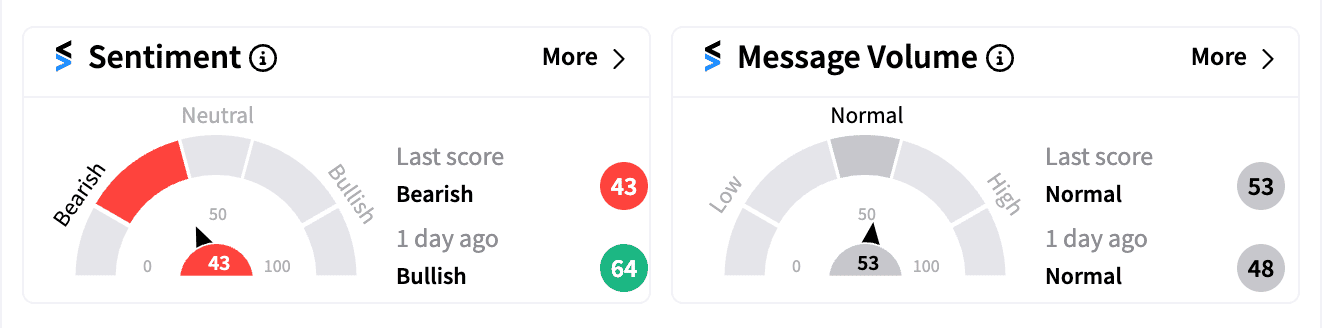

Retail sentiment was ‘extremely bullish’ for MSTR and MARA pre-market Monday but ‘bearish’ for RIOT as of 8 a.m. ET.

Additionally, Barclays has raised its price target on MicroStrategy to $225 from $173 while maintaining an ‘Overweight’ rating. The brokerage noted that while Bitcoin prices remain elevated, MicroStrategy is well-positioned to further build its “war chest” of Bitcoin holdings.

MicroStrategy, which views itself as a Bitcoin development company, has steadily accumulated cryptocurrency during recent price dips.

Last month, the company revealed that the group now holds approximately 252,220 bitcoins, acquired for about $9.9 billion at an average purchase price of $39,266 per Bitcoin. At current prices, the holding is worth nearly $16.4 billion.

While MSTR has more than tripled this year, MARA and RIOT, both Bitcoin miners, have seen their stocks fall by nearly 30% and 45%, respectively, year to date.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)