Advertisement|Remove ads.

MicroStrategy Stock Surges On Bitcoin Strength, Benchmark’s Price-Target Hike: Retail Grows More Bullish

Shares of MicroStrategy, Inc. ($MSTR) surged over 9% on Friday afternoon, fueled by gains in apex cryptocurrency Bitcoin ($BTC.X).

Bitcoin was trading up more than 2% at $68,639 as of 12:30 PM ET, just about 4% shy of its all-time high of $73,798.

Bitcoin has rallied over 11% in the past week, reportedly driven by optimism surrounding the regulatory outlook in the U.S. ahead of November’s presidential election.

Vice President Kamala Harris, the Democratic candidate, has pledged support for a comprehensive regulatory framework for the crypto industry, while her Republican opponent, Donald Trump, is openly pro-crypto.

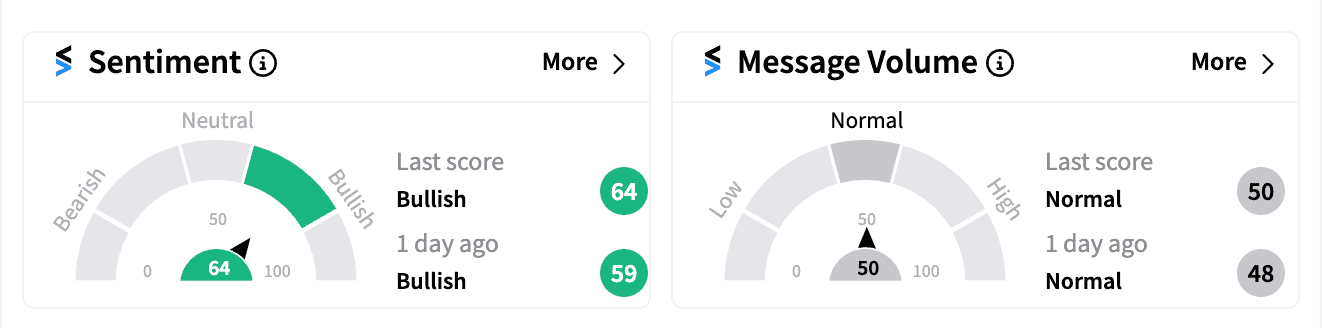

On Stocktwits, retail sentiment for MSTR strengthened within the ‘bullish’ zone, rising to 63/100, with many users hopeful for a continued rally.

Further boosting sentiment, Benchmark on Friday raised its price target for MicroStrategy to $245 from $215, maintaining a ‘Buy’ rating.

The analyst highlighted the company’s significant outperformance over the past four years as evidence of the success of its Bitcoin acquisition strategy.

In an interview with journalist Madison Reidy aired on Thursday, MSTR founder and CEO Michael Saylor dared skeptics to short his company, adding, “I want you to love us if you really hate BTC.”

MicroStrategy has continued to accumulate Bitcoin during price dips, reinforcing its position as a Bitcoin development company.

Last month, the company reported holding approximately 252,220 bitcoins, acquired for $9.9 billion at an average purchase price of $39,266 per Bitcoin.

Benchmark said its price target is based on a “sum-of-the-parts” analysis, factoring in the estimated year-end 2025 value of both the company’s Bitcoin holdings and its enterprise software business.

MSTR stock has more than tripled so far this year, outperforming Bitcoin’s 55% gains. Over the past five years, the company’s shares have soared by 1,370%, far exceeding Bitcoin’s 760% rise.

Read next: Peloton Stock Gains Momentum, Retail Attention As Earnings Near: Here’s What Analysts Expec

/filters:format(webp)https://news.stocktwits-cdn.com/large_chipotle_resized_jpg_3186b6d948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_chart_trending_march_jpg_ad3a86ed42.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)