Advertisement|Remove ads.

Multiple Boeing Planes Reportedly Sent Back To Seattle From China Amid Escalating Trade War, But Retail’s Bullish

Boeing (BA) stock could draw retail attention on Monday, as at least two 737 Max jets intended for Chinese airline firms returned to the company’s manufacturing facility in Seattle, according to media reports.

On Sunday, a 737 Max aircraft from Boeing’s Zhoushan center flew to Seattle via the U.S. territory of Guam, painted with Xiamen Airlines livery, according to a Reuters report.

Another 737 Max aircraft landed at Guam on Monday, which was coming from Zhoushan, according to the report.

Bloomberg reported last week that the Chinese government had instructed domestic airlines to stop accepting Boeing jet deliveries amid ongoing trade tensions between the two countries.

The U.S. currently maintains a steep tariff rate of 145% on most Chinese goods. In retaliation, Beijing has increased tariffs on U.S. goods to 125%, which could particularly hurt demand for the multimillion-dollar aircraft.

While China remains an important market for Boeing, some analysts have called the situation unsustainable, noting the U.S.-firm’s main rival, Airbus, likely can't be the country's sole large jet supplier due to capacity limits.

Boeing is in the midst of a turnaround effort led by CEO Kelly Ortberg after a crippling worker strike and a production cap on its best selling 737 Max program cast doubts over its ability to retain investment grade rating.

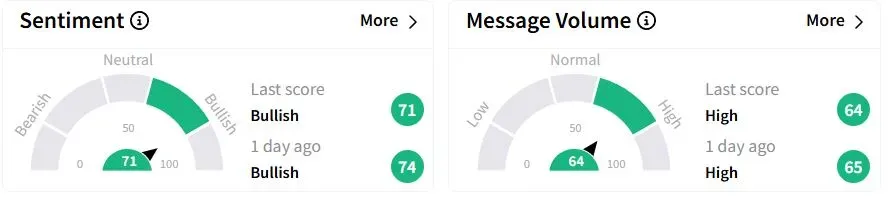

Retail sentiment on Stocktwits was in the ‘bullish’ (71/100) territory, while retail chatter remained ‘high.’

Retail investors were optimistic that Boeing could repurpose the planes and send them to other countries.

The company is scheduled to report its results on April 23.

Boeing shares have fallen 9.2% year-to-date (YTD).

Also See: GE Aerospace Q1 Preview: Trade War To Overshadow Strong Backlog? Retail’s Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_8bc1596785.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239888469_jpg_5e0e3b606c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2170386387_jpg_600d460275.webp)