Advertisement|Remove ads.

Nano Nuclear Energy’s December-Quarter Losses Widen: Retail Sentiment Sours

Shares of Nano Nuclear Energy Inc. (NNE) were in the spotlight on Friday morning after the company reported its quarter-ended December earnings.

Operating losses widened to $3.92 million from $1.35 million a year earlier. According to FinChat data, the company reported an earnings loss of $0.09, wider than an expected loss of $0.07. Net loss rose to $3.11 million compared to a loss of $1.31 million in the year-ago period.

As of Dec. 31, 2024, the company had a working capital of $125.934 million and an accumulated deficit of $20.58 million.

Nano Nuclear said in an exchange filing that it has not generated any revenue to date and does not expect to generate any revenue unless and until it is able to commercialize its reactors.

“We will require additional capital to develop our reactors and to fund operations for the foreseeable future. We expect our costs to increase in connection with the advancement of our reactors toward commercialization. While we believe that our existing cash may be sufficient to support the development of our reactors in the near term, certain costs are not reasonably estimable at this time, and we may require additional funding,” the company said.

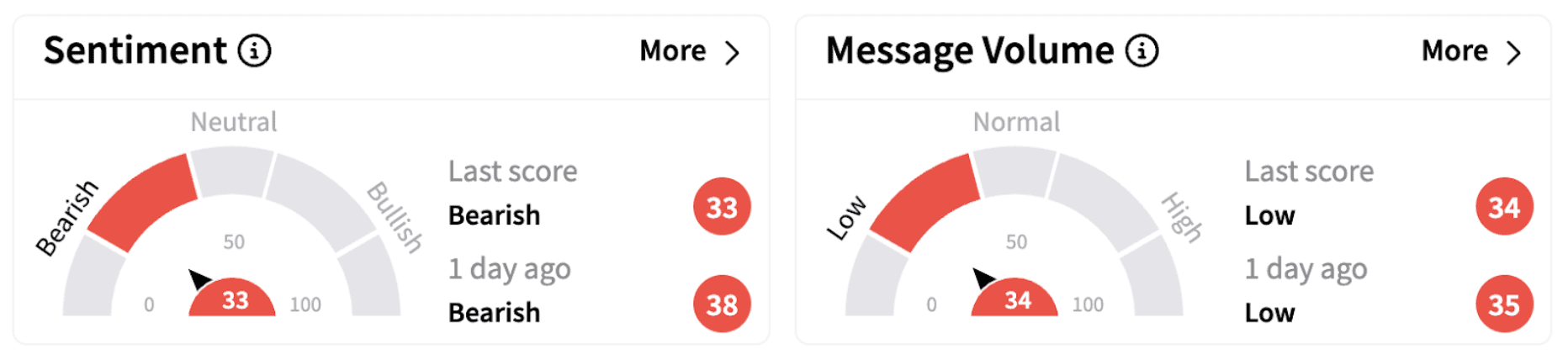

Following the release of the earnings report, retail sentiment on Stocktwits dipped further into the ‘bearish’ territory (33/100).

On Thursday, the company disclosed its inclusion in the MSCI USA Index, effective as of Feb. 28, 2025, following the February index review by MSCI Inc.

Nano Nuclear founder and chairman Jay Yu said the inclusion will significantly enhance the firm’s visibility and accessibility among capital markets and institutional investors worldwide.

NNE shares have gained nearly 41% in 2025 and have risen almost 550% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)