Advertisement|Remove ads.

Netflix Q1 Earnings On Deck: Retail Factors In Solid Beat And Hopes For Stock Split

Netflix, Inc. (NFLX) is scheduled to report its quarterly results even as the market navigates troubled waters stemming from tariffs and the resultant economic and geopolitical uncertainty.

Hyping up expectations is a recent Wall Street Journal report that said company executives exuded optimism at an annual review meeting held in March.

Buoyed by improving fundamentals, the company has set its sights on clinching the $1 trillion market-cap mark.

The Koyfin-compiled consensus estimates call for the streaming giant to report earnings per share (EPS) of $5.68 and revenue of $10.51 billion for the first quarter of the fiscal year 2025.

This compares to the year-ago EPS of $5.29 and revenue of $9.37 billion, and the previous quarter’s $4.27 and $10.42 billion, respectively.

The topline will likely get a boost from the price increases the company announced across the geographies in the first quarter.

In late January, when the company reported its fourth-quarter results, it raised its 2025 revenue guidance to $43.5 billion to $44.5 billion.

Netflix has opted to stop reporting membership numbers and average revenue per member (ARM), beginning in 2025.

Morgan Stanley recently announced Netflix stock as its top media pick, primarily due to its view that the company is resilient to macroeconomic vagaries.

Earlier this week, UBS reduced the price target for Netflix stock to $1,140 from $1,150 but maintained a ‘Buy’ rating, TheFly reported. Analysts at the firm said with the company limiting data on subscriber growth, investors will likely focus on engagement.

According to the firm’s viewership tracker, numbers have been on an upward trajectory following a period of stagnation amid the password sharing clampdown and Hollywood writers’ strike-related headwinds.

“The macro situation remains fluid but we continue to view Netflix as a relative outperformer in the broader media space," the brokerage said.

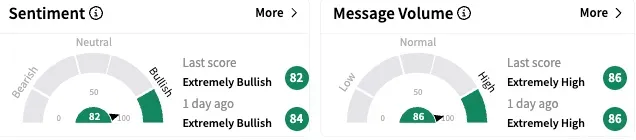

On Stocktwits, sentiment toward Netflix stock remained ‘extremely bullish’ (82/100), heading into the print, with the message volume also at ‘extremely high’ levels.

A bullish watcher said Netflix showed solid strength ahead of earnings, being one of the 74 S&P 500 stocks trading above its 50-day moving average which is still above the longer-term 200-day moving average.

Retail investors have also been calling for a stock split to bring the stock to more affordable levels.

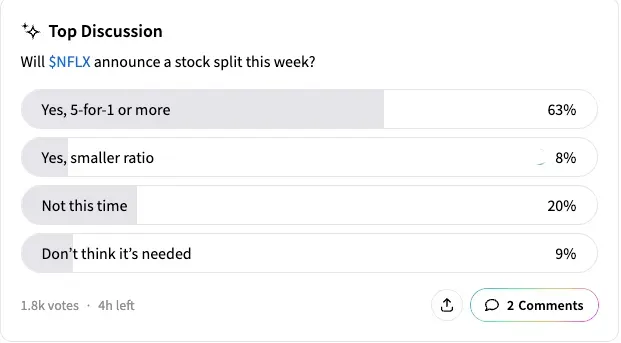

An ongoing Stocktwits poll that asked users whether Netflix will announce a stock split this week received responses from 1,800 users. More than two-thirds of the respondents (71%) rooted for a split, with 63% bracing for a 5-for-1 ratio or more.

Only 20% said it was not time to announce a stock split and a more modest 9% said a stock split wasn’t warranted.

Netflix stock ended Wednesday’s session down 1.50% at $961.63 but it is up about 8% this year. In Thursday's premarket session, the stock rose by 1.18%.

The Koyfin-compiled consensus analysts’ price target for the stock is $1,065.05.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)