Advertisement|Remove ads.

Netflix Replaces Disney As Morgan Stanley’s Top Media Pick Ahead Of Q1 Print: Retail Mood Is Subdued

Netflix, Inc.’s (NFLX) first-quarter results are a week away, and ahead of the key event, the streaming giant received endorsement from a Wall Street firm.

In a note released Wednesday, Morgan Stanley named Netflix as its top media & entertainment pick, swapping positions with Walt Disney Co. (DIS).

Analyst Benjamin Swinburne reiterated an ‘Overweight’ rating and $1,150 price target for Netflix stock, implying about 22% upside potential from Wednesday’s close

The analyst based his positive opinion to his view that the streaming giant is relatively resilient in a weaker global macro environment.

President Donald Trump’s sweeping tariffs announced last week raised the specter of a recession although he has relented since then and announced a 90-day pause in implementing the levies for most nations with the notable exception being China.

Swinburne adjusted his 2025 advertising revenue growth estimate for Netflix to 15.4% excluding currency impacts, leaving his reported growth forecast unchanged at 13.5%.

He targets advertising revenue of $1.3 billion in 2025, up from $700 million last year, assuming growth in ad-supported users and no growth in advertising revenue per member (ad RAM).

Delving into Netflix’s Engagement Report for the second half of 2024, the analyst said roughly 30% of hours streamed were for non-English language content, original and exclusive programming dominated most popular programming. He also noted deep engagement in Netflix library.

The analyst expects a durable growth model for Netflix due to uniquely global programming and production capabilities, a vertically integrated business model, and an appreciating content asset.

Retail traders, however, remained cautious on Netflix. An ongoing Stocktwits poll found that only 12% of the respondents counted the company as the communication services stock they would buy.

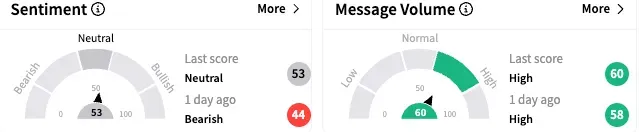

Users on the platform were ‘neutral’ (53/100) toward Netflix stock by late Wednesday, although it was better than the ‘bearish’ mood from a day ago. The message volume on the stream stayed ‘high.’

A bullish watcher based his optimism on expectations the company will report a blowout earnings next week.

However, another user called the Netflix stock a “bear trap.”

Netflix ended Wednesday’s session up 8.62% at $945.47, with the stock now up 6% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)