Advertisement|Remove ads.

Netflix Stock Dips Premarket: Most Retail Traders Expect Q3 Earnings Beat Next Week

Netflix, Inc. (NFLX) shed nearly 0.5% in Friday's early premarket session, potentially moving down along with the broader market, even as retail traders remain optimistic about the streaming giant's upcoming quarterly results.

The Los Gatos, California-based company is scheduled to report third-quarter earnings after the market closes on Tuesday. According to the Fiscal. ai-compiled consensus, Netflix is expected to report earnings per share (EPS) of $6.95 on revenue of $11.52 billion for the quarter.

The guidance issued in late July calls for third-quarter revenue of $11.53 billion, marking 17.3% growth, an operating margin of 31.4% and EPS of $6.87.

On an encouraging note, the company's content slate is more back-end loaded for the year. That said, Netflix's stock came under selling pressure after Tesla CEO Elon Musk slammed the company for its woke content and called for canceling subscriptions.

The company's full-year guidance now stands at $44.8 billion to $45.2 billion, following an upward revision in late July.

A note from Wedbush earlier this week showed that it expects ad revenue to become Netflix's primary revenue driver beginning in 2026, according to The Fly. The brokerage stated that Netflix can accelerate ad revenue contribution for the next several years by adding and improving live events, enhancing ad targeting, expanding ad partnerships, and broadening its content strategy, the firm argues. The firm also sees limited churn due to engaged premium and ad subscribers.

The firm reiterated an 'Outperform rating' on the stock with a price target of $1,500, which represents a nearly 25% surge from the last close.

An ongoing Stocktwits poll, powered by Polymarket, showed that 57% of the respondents expect an earnings beat, while 43% do not root for a beat.

"With Elon Musk leading a consumer revolt and service cancellations, how could they beat earnings? People are sick of the Woke ideology in their shows," said one bearish user, referring to the Tesla CEO's recent outrage against the streaming service for allegedly promoting "transgender woke agenda."

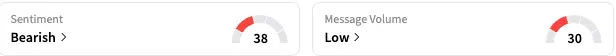

Retail sentiment toward Netflix stock on Stocktwits remained 'bearish' as of early Friday, and the message volume on the stream was at 'low' levels.

Netflix stock has gained nearly 33% this year, outperforming the broader market and the communication services sector.

On Tuesday, AMC CEO Adam Aron said that the movie theater chain has agreed to collaborate with Netflix, starting with the Halloween weekend. Netflix's most-popular movie in its history, KPop Demon Hunters, will play on approximately 400 AMC screens across its theatres in the U.S. and Europe, he added.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why GitLab Stock Is Falling About 4% In Premarket Trading Today

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)