Advertisement|Remove ads.

India Market Wrap: Nifty Ends Below 25,100 As IT, FMCG Stocks Drag; IEX Crashes 28%

A day after posting a healthy recovery, Indian equity markets ended the weekly expiry session sharply lower on Thursday, dragged by IT, FMCG, and real estate shares. The Nifty ended below the 25,100 level.

India and the UK signed the Free Trade Agreement, which is expected to double bilateral trade to $120 billion by 2030. On the other hand, a trade deal with the US remains elusive ahead of the August 1 deadline.

On Thursday, the Sensex closed 542 points lower at 82,184, while the Nifty 50 ended 157 points lower at 25,062. Broader markets too reeled under pressure, with the Nifty Midcap index falling 0.5% and the Smallcap index declining 1%.

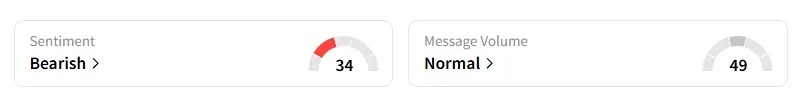

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Sectorally, PSU banks logged gains of 1.2%, while the IT index fell 2.2%, followed by FMCG, which was down 1.2%.

IEX shares ended 28% lower, after hitting the lower circuit twice. The selloff follows the electricity regulator's approval of market coupling for the day-ahead segment, sparking concerns over its market advantage.

Analyst Mayank Singh Chandel identified the next important support level at ₹117-108, although he believes the company remains fundamentally sound. He advised long-term investors to avoid panic selling and monitor IEX’s results over the next few quarters. For those with considerable investments, he said it would be prudent to reduce some exposure to maintain a balanced and diversified portfolio.

In earnings reactions, Infosys (-1.3%), Persistent (-8%), and Coforge (-9%) saw declines after their Q1 performance failed to impress the street. Nestle India also fell 5% and was the top Nifty loser, following its earnings announcement.

On the other hand, Dr Reddy’s rose nearly 2%, while Indian Bank and Canara Bank surged 5%, driven by their steady June quarter performance.

Tilaknagar ended nearly 5% higher following its acquisition of Imperial Blue for ₹4,150 crores.

Globally, European markets traded higher on hopes for an EU-U.S. trade deal, while US stock futures indicate a strong start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)