Advertisement|Remove ads.

Northern Trust Stock Ignites Retail Trader Buzz After Refuting BNY Mellon Deal Rumors

Northern Trust (NTRS) saw a surge in retail chatter on Monday after it said that it remains fully committed to staying independent, hours after an article by the Wall Street Journal said that Bank of New York Mellon was exploring a merger with the asset manager.

Shares of Northern Trust still closed 8% higher on Monday, marking their best day in over two months.

"I can tell you that Northern Trust is fully committed to remaining independent and continuing to deliver long-term value to our stakeholders, as we have for the past 135 years," its spokesperson said, according to Reuters.

The Journal reported, citing people familiar with the matter, that the CEOs of both banks have held at least one conversation regarding the merger. The two, however, haven’t discussed any specific offer.

BNY is reportedly the next step, such as making a formal offer. Any potential deal will create an “investment management powerhouse,” overseeing over $3 trillion in assets.

Both BNY and Northern Trust offer a wide range of services, including holding, managing, and transferring money on behalf of corporations, investment firms, and financial advisors. Before the report on Monday, Northern Trust had a market capitalization of $22 billion, while BNY had a valuation of $66 billion.

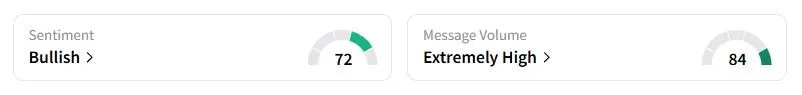

Retail sentiment on Stocktwits about Northern Trust was ‘bullish’ (73/100), while 24-hour message volume on the stock surged by 2,500%.

"We believe the bar is soon to be lowered for larger bank mergers. This potential deal would involve a Category 1 bank and a Category 2 bank, which may still face a higher hurdle than two super-regional banks," analysts at Keefe, Bruyette & Woods said.

Year to date, Northern Trust shares have gained about 16.7% while BNY stock is up about 16%, including Monday’s gains.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)