Advertisement|Remove ads.

NOV Posts 39% Fall In Q1 Earnings As CEO Cites Mounting Macroeconomic Uncertainty, Yet Retail’s Extremely Bullish

NOV Inc (NOV) stock fell 1.8% in premarket trading on Tuesday after the company reported a 39% fall in quarterly earnings.

The oilfield equipment provider reported a net income of $73 million, or $0.19 per share, for the three months ended March 31, compared with $160 million, or $0.41 per share, in the year-ago quarter.

Revenue fell 2% to $2.10 billion for the reported quarter, but it was in line with Wall Street’s expectations.

Its revenue from Energy Products and Services fell 2% to $992 million, while revenue from Energy Equipment declined 3% to $1.15 billion.

“The macroeconomic drama of the past few weeks, including global trade tensions, weakening economic outlook, and incremental OPEC+ production, is increasing uncertainty and caution among our customers,” said CEO Clay Williams.

Due to tariff uncertainty, HSBC has lowered its forecast for Brent oil prices in 2025 to $68.50 per barrel, down from its previous estimate of $73 per barrel.

“Looking ahead, we expect macroeconomic and geopolitical uncertainties to persist, causing incrementally lower activity in the second half of the year,” Williams added.

However, the company said it would post modest sequential revenue improvement in the second quarter.

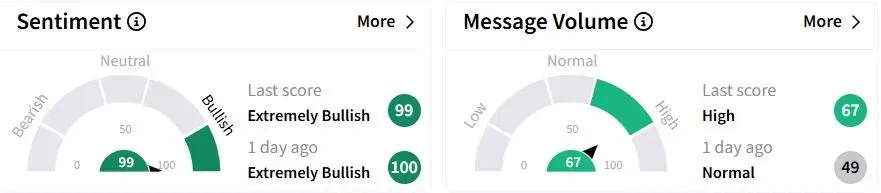

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (99/100) territory while retail chatter was ‘high.’

One retail investor expressed optimism about the results amid weak margins in the sector.

Nov shares have fallen 17% year to date (YTD).

Also See: Welltower Lifts 2025 FFO Outlook, Earnings Forecast As Senior Housing Demand Surges

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)