Advertisement|Remove ads.

Welltower Lifts 2025 FFO Outlook, Earnings Forecast As Senior Housing Demand Surges

Welltower (WELL) stock garnered retail attention on Monday after it raised its funds from operations forecast for 2025.

The real estate investment trust raised its full-year normalized funds from operations (FFO) to a range of $4.90 to $5.04 per share, up from $4.79 to $4.95 per share, as projected earlier.

Welltower also raised its 2025 earnings forecast to a range of $1.70 to $1.84 per diluted share, up from the previous range of $1.60 to $1.76 per diluted share.

The company’s first-quarter revenue of $2.42 billion was roughly in line with Wall Street’s expectations.

Its resident fees and services segment revenue jumped to $1.86 billion, compared with $1.36 billion in the year-ago quarter.

Welltower reported a net income of $257.9 million, or $0.40 per share, for the three months ended March 31, compared with $127.1 million, or $0.22 per share, a year earlier.

The company has benefited from a strong demand for senior housing. It has made several acquisitions this year to bolster its presence in the segment.

It agreed to buy luxury senior housing provider Amica Senior Lifestyles’ portfolio and certain assets from the Ontario Teachers’ Pension Plan Board in March for C$4.6 billion.

In January, Welltower agreed to buy NorthStar Healthcare Income, an owner of senior housing properties, in a deal valued at $900 million.

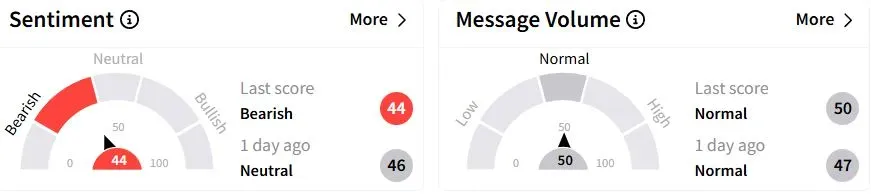

Retail sentiment on Stocktwits was in the ‘bearish’ (44/100) territory compared with ‘neutral’(46/100) a day ago, while retail chatter was ‘normal.’

Welltower shares have gained 18.6% year-to-date (YTD).

Also See: Amazon Sends First Kuiper Satellites To Space To Rival Starlink, Telecom Giants

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)