Advertisement|Remove ads.

Novo Nordisk Hit With Stock Downgrades After Lowering Full-Year Outlook: But Retail Is Optimistic On Company’s Profitability

Shares of Danish drugmaker Novo Nordisk (NVO) traded 8% lower on Wednesday afternoon after the company slashed its full-year guidance, prompting downgrades from Wall Street.

Novo said on Tuesday that it now expects sales growth of 8% to 14% during the year at a constant exchange rate, down from its previous estimate of 13% to 21%.

Operating profit growth is now expected to be 10% to 16%, down from its previous outlook of 16% to 24%.

The company said that it expects lower growth for its blockbuster weight-loss drug Wegovy in the U.S. obesity market and for Ozempic in the U.S. diabetes market, as well as lower-than-expected penetration for Wegovy in select international operations markets.

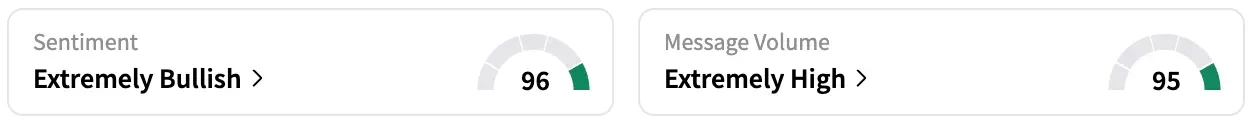

On Stocktwits, retail sentiment around NVO is trending in the ‘extremely bullish’ territory, coupled with ‘extremely high’ message volume.

A Stocktwits user highlighted what could be the company’s path to recovery.

Novo Nordisk said in May that the FDA has accepted its new drug application for a once-daily oral formulation of Wegovy, and it expects a response from the agency in the fourth quarter (Q4) later this year.

Another user opined they will hold the stock for the long term.

Bank of America on Wednesday downgraded Novo Nordisk to ‘Neutral’ from ‘Buy’ with a price target of DKK 375 ($57.72), down from DKK 550, as per TheFly.

The firm lowered its 2026/2027 estimates for Novo’s Wegovy by about 20% with an unclear timeline for resolution of compounding, which the company cited among the main headwinds in its guidance cut. It lowered its 2025 EPS forecast by about 5%, its 2026 view by about 12% and outer years by a mid-high teens percentage.

While the U.S. Food and Drug Administration has prohibited mass compounding for the active component in Wegovy called Semaglutide, unsafe and unlawful mass compounding has continued, Novo said on Tuesday, while pinning the guidance cut to persistence of compounding, among other factors.

Barclays, meanwhile, downgraded Novo to ‘Equal Weight’ from ‘Overweight’ with a price target of DKK 375, down from DKK 700.

The company's profit warning may be a "kitchen sink," but semaglutide's return to volume growth lacks visibility, the analyst told investors in a research note. Barclays does not see a catalyst to get investors to return to the story, given that the company’s pipeline is lagging behind its rival Eli Lilly’s.

NVO stock is down by 42% this year and by about 61% over the past 12 months.

Read also: REPL Stock Nearly Doubled In Value Today: What's Going On?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: DKK 1= $0.15

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)