Advertisement|Remove ads.

NuScale, Oklo Stocks Surge as Amazon, Google Bet on Nuclear Expansion – But Retail Sentiment Pulls Back

Shares of nuclear reactor developers NuScale Power (SMR) and Oklo (OKLO) surged in midday trading Wednesday after a coalition of tech giants pledged support for tripling global nuclear energy capacity by 2050.

The pledge, backed by Amazon (AMZN), Google (GOOGL, GOOG), and Meta Platforms (META), was signed on the sidelines of the CERAWeek conference in Houston.

The initiative, facilitated by the World Nuclear Association (WNA), aims to expand nuclear power as a reliable, carbon-free energy source. The WNA said in a statement that additional support is expected from industries such as maritime, aviation, and oil and gas in the coming months.

Traditional nuclear power providers also registered gains on the news. Constellation Energy Corporation (CEG) shares climbed nearly 5%, while Vistra’s (VST) stock jumped more than 10%.

The push for nuclear expansion builds on a 2023 agreement among more than 30 countries that set a similar goal. According to WNA data, nuclear power currently accounts for about 9% of global electricity generation, with 439 reactors in operation.

As Amazon and Google seek to decarbonize their energy-intensive data centers, they are also investing in small modular reactors (SMRs) to address the financial and logistical challenges of building new nuclear plants.

NuScale and Oklo offer two different approaches to nuclear expansion. NuScale is developing grid-scale SMRs, while Oklo is working on decentralized microreactors designed for off-grid or co-located deployment.

Both companies have seen stock surges in the past on data center partnership news, though their first-of-a-kind projects carry execution risks.

NuScale’s first U.S. reactor is expected to come online in 2029, while Oklo is targeting 2027 for its Idaho plant. Meanwhile, Constellation, the country’s largest nuclear power operator, is positioning itself to meet growing demand from hyperscale data centers.

Despite the rally, retail sentiment around both stocks remained mixed.

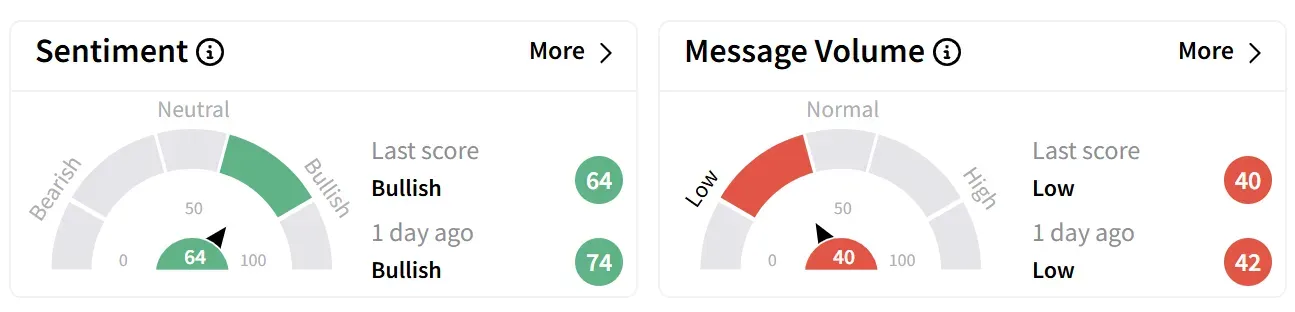

On Stocktwits, sentiment toward Oklo’s stock dipped but remained in ‘bullish’ territory.

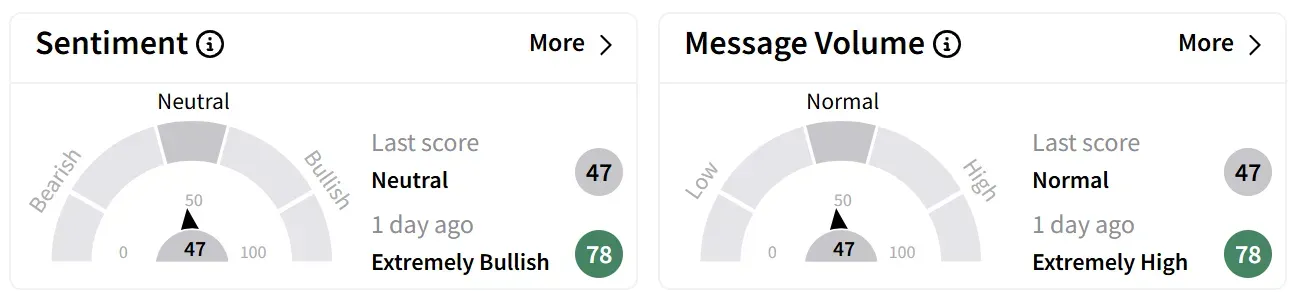

NuScale, however, saw its retail sentiment fall from ‘extremely bullish’ to the ‘neutral’ zone.

Both stocks have posted triple-digit gains over the past year, but Oklo has outperformed in 2025.

Oklo shares have climbed 152% over the past year and are up 28% year-to-date. Meanwhile, NuScale’s stock has gained 197% over the past year but is up just 11% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Snowflake Stock Rises On AI Partnership Rumors With Google – Retail Remains Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)