Advertisement|Remove ads.

Nuvation Bio Stock Logs Its Best Session Ever: Wall Street Turns Bullish On Lung Cancer Drug’s Blockbuster Debut

- Shares jumped after Wedbush raised its target and B. Riley initiated coverage, pointing to strong early launch momentum for the new lung-cancer therapy.

- The company reported 204 first-quarter patient starts and outlined revenue potential between $220 million and $2 billion.

- Fresh glioma data, upcoming ex-U.S. partnership plans, and an expected Phase I/II update added to investor enthusiasm.

Nuvation Bio, Inc. logged its best trading session on record after a wave of bullish analyst updates tied to the first full-quarter results for its newly launched ROS1 lung-cancer therapy. The stock jump followed new commentary from the company during its appearance at the Jefferies London Healthcare Conference 2025, prompting multiple brokerages to boost their outlook.

The stock closed up 49% at $7.15, hitting nearly a four-year high, and added another 1.4% in after-hours trading.

Analysts Turn Bullish

Wedbush raised its price target to $11 from $7 and reiterated an ‘Outperform’ rating.

Meanwhile, B. Riley initiated coverage with a ‘Buy’ rating and a $12 price target, highlighting the company’s strong early commercial revenue ramp in mutation-defined lung cancer. The firm said the therapy’s launch is being supported by what it described as “class-leading attributes” that continue to underpin robust early metrics.

New Lung Cancer Therapy

During the conference, Nuvation said its first full quarter of sales for its ROS1 inhibitor resulted in 204 new patient starts, six times the number logged by its closest competitor in its comparable launch period. The company reported a 90% response rate and a 50-month duration of response in updated data already submitted for a label amendment.

The company said that even without additional growth, the current quarterly intake alone could support annual revenue ranging from $220 million to $2 billion, depending on the mix of first-line and second-line patients. Access has expanded to more than 80% of covered lives, with minimal need for fast-start support programs.

New Glioma Data

Investors also reacted to new data for the company’s IDH1 inhibitor, which showed a 44% response rate in low-grade glioma, marking four times that of the INDIGO study’s comparator, and an 88% two-year progression-free rate. Nuvation Bio said its program covering both low-grade and high-grade glioma is underway and expected to read out by 2029.

The company said it no longer plans a head-to-head comparison study, citing the strength and separation of the newly disclosed data.

The Path Ahead

Nuvation said its adjuvant study for ROS1 lung cancer is progressing and will run for several years. An ex-U.S. commercial partnership is expected before year-end, ahead of commercial ramp-ups in China and Japan.

The company reported $549 million in cash at the end of the last quarter and maintained that its balance sheet is sufficient to take it through to profitability. The Phase I/II trial of its NUV-1511 drug-drug conjugation program remains ongoing, with updates due before the end of the year.

Stocktwits Mood Turns Upbeat

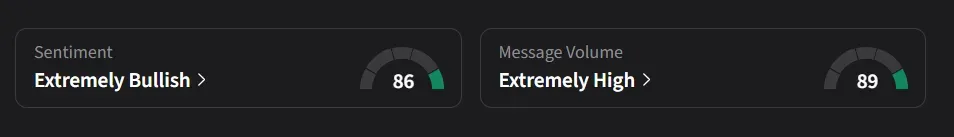

On Stocktwits, retail sentiment for Nuvation Bio was ‘extremely bullish’ amid a 1,538% surge in 24-hour message volume.

One user said, “buying 2000 more shares at this level,” while another said, “The fact that it's doing so well on a red day is amazing!”

Nuvation Bio’s stock has risen 49% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)