Advertisement|Remove ads.

Nvidia, Broadcom, UiPath, Lululemon Athletica, Apple: What Sparked Heavy After-Hours Trading In These 5 Stocks?

U.S. stocks advanced strongly on Thursday as rate hike odds rose after the release of soft labor market data, including a smaller-than-expected private payrolls gain and a rise in weekly jobless claims.

The following stocks saw substantial volumes in the after-hours session, even as traders braced for the all-important monthly jobs data:

Nvidia Corp. (NVDA)

After-hours move: -0.21%

Trading volume: 12.04 million

Nvidia’s stock snapped a five-session losing streak on Thursday, thanks to the economic data points that inspired some bargain hunting in the stock. The stock, however, reversed course in the after-hours.

An Information report stated late Thursday that Nvidia has agreed to a couple of deals to rent its own chips it sold to Lambda, a cloud startup in which the artificial intelligence (AI) frontrunner has taken a stake. The Jensen Huang-led company has reportedly agreed to pay $1.6 billion for the two deals.

On Stocktwits, retail sentiment toward the stock stayed ‘bearish’ (31/100) as of late Thursday and the message volume also remained at ‘low’ levels.

The stock has gained roughly 28% year-to-date (YTD).

Broadcom, Inc. (AVGO)

After-hours move: +4.58%

Trading volume: 8.03 million

AI chipmaker Broadcom reported forecast-beating results for the third quarter of the fiscal year 2025 and issued above-consensus revenue guidance for the fourth quarter. On the earnings call, CEO Hock Tan spoke about an unnamed prospective customer who firmed up a $10 billion chip order. A Financial Times report, citing sources, identified the new customer as OpenAI.

Retail sentiment toward Broadcom stock improved to ‘extremely bullish’ levels (95/100) as of late Tuesday, with the message volume also rising to ‘extremely high’ levels.

Broadcom stock has gained nearly 33% this year.

UiPath, Inc. (PATH)

After-hours move: +5.07%

Trading volume: 6.09 million

UiPath stock came under investors’ radar amid the release of quarterly results by the enterprise automation and AI software company. The New York-based company reported adjusted earnings per share (EPS) of $0.15 for the second quarter of fiscal year 2026, up from $0.04 last year, and exceeding the Fiscal.ai-compiled consensus of $0.08.

Quarterly revenue climbed 11% year-over-year (YoY) to $362 million, versus the consensus of $347.34 million.

The company raised its full-year revenue guidance, which is above the mean analysts’ estimate. The third-quarter revenue guidance also bettered Wall Street’s average forecasts.

The UiPath stock, which is down 14.63% YTD, elicited ‘extremely bullish’ sentiment (96/100) among retailers and the message volume also reached ‘extremely high’ levels.

Lululemon athletica, Inc. (LULU)

After-hours move: -15.73%

Trading volume: 5.73 million

Lululemon stock cratered in Thursday’s extension session after the athletic apparel and accessories retailer reduced its full-year outlook, citing higher levels of tariffs on imports to the U.S. and the removal of the de minimis exemption.

The second-quarter results for fiscal 2025, however, showed bottom-line results that exceeded the consensus and revenue that aligned with Street forecasts.

Notwithstanding the stock plunge, retail traders got more positive on Lululemon’s stock, sporting ‘extremely bullish’ sentiment (94/100) and ‘extremely high’ message volume.

The stock has lost a whopping 46% this year.

Apple, Inc. (AAPL)

After-hours move: -0.24%

Trading volume: 3.70 million

Apple’s stock extended its gains on Thursday, adding 0.55% in the regular session, although it slipped modestly in the after-hours.

Traders digested the report of the tech giant unveiling an improved Siri personal assistant in Spring 2026, which will feature, among other things, an AI-enabled search. Favorable implication of Alphabet unit Google’s antitrust ruling gave a lift to the stock in Wednesday’s session.

The company is also gearing up for its new hardware event, dubbed ‘Awe Dropping,’ scheduled for Sept. 9, in which it is widely expected to launch the iPhone 17.

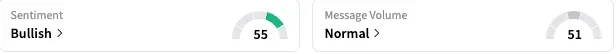

Apple retail traders turned ‘bullish’ (55/100) on the stock, but the message volume remained at ‘normal’ levels.

The tech giant’s shares are down about 4% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)