Advertisement|Remove ads.

Nvidia Hits 4-Month Low as Microsoft, Meta Fail To Ease AI Competition Fears: Retail Dismisses DeepSeek Concerns

Nvidia Corp. (NVDA) stock edged 0.5% lower in pre-market trade on Thursday after earnings calls by Microsoft Corp. (MSFT) and Meta Platforms (META) did little to assuage market concerns about the impact of China’s DeepSeek AI.

The stock had already fallen over 4% on Wednesday and is now trading at levels last seen in October.

So far this week, the stock has lost 13% of its value, hit by investor concerns over competition from China’s DeepSeek AI and potential new U.S. restrictions on chip sales to China.

The market was looking to Meta and Microsoft’s earnings for reassurance.

While both Magnificent 7 companies reported robust capital expenditures – totaling $37.4 billion in the December quarter – Microsoft signaled a slowdown in AI-related data center spending next year.

Meta CEO Mark Zuckerberg struck a more optimistic tone, arguing that it was "too early" to assume DeepSeek’s AI advancements would reduce long-term AI investment needs.

He reiterated the company’s commitment to “hundreds of billions of dollars” in AI spending.

However, Meta also highlighted its in-house AI chips, developed in partnership with Broadcom (AVGO), as potential replacements for Nvidia’s GPUs in some of its servers.

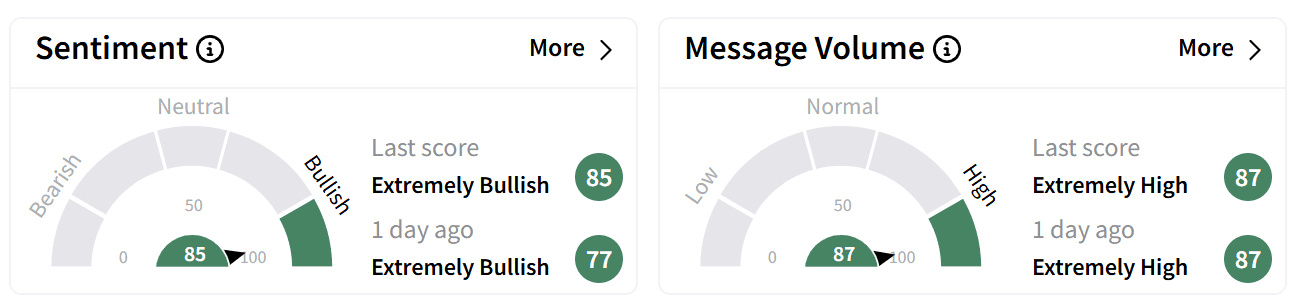

Despite the market’s reaction, retail sentiment on Stocktwits around Nvidia remained in the ‘extremely bullish’ territory as chatter remained steady at ‘extremely high’ levels.

Users dismissed concerns over DeepSeek, arguing that competition would not significantly impact Nvidia’s dominance in AI chips.

Nvidia’s stock has more than doubled over the past year, but its performance this year has been less impressive with a 9% dip so far.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Bitcoin, Ethereum Gain As Powell Reaffirms Banks Can Engage with Crypto: Retail Still Feels Skiddish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)