Advertisement|Remove ads.

Occidental Petroleum Stock In Spotlight After EPA Approves CO2 Storage In Texas, Retail’s Split On Future

Occidental Petroleum (OXY) stock was in focus on Monday after it secured permits from the U.S. Environmental Protection Agency (EPA) to store carbon dioxide in underground wells in Texas.

The permits were the first ones the EPA issued in Texas for Class VI wells under the Safe Drinking Water Act Underground Injection Control program.

According to the EPA, Class VI injection wells store carbon dioxide (CO2) deep underground, either captured from an emissions source or the atmosphere.

The approved project is 14 miles from the city of Odessa and includes three wells that will store about 722,000 metric tons of carbon dioxide per year at a depth of about 4,400 feet.

Occidental said the wells would store CO2 captured from STRATOS, which is the world’s largest Direct Air Capture (DAC) facility in Ector County, Texas. Occidental has expressed intentions to build 100 DAC facilities by 2035.

STRATOS is built under a joint venture between Occidental and BlackRock. The facility could capture up to 500,000 tonnes of CO2 annually after it begins operations, which is expected later this year.

“Oxy Low Carbon Ventures has demonstrated their ability and intention to operate these wells responsibly while creating jobs and supporting the Texas economy,” EPA Regional Administrator Scott Mason said.

Carbon capture and storage (CCUS) has drawn interest from corporations and countries alike, but there are some concerns surrounding their scalability and environmental damages. Some experts have expressed worries that injecting CO2 underground in large quantities could cause earthquakes.

Occidental shares fell 4.4% on Monday, tracking a decline in oil prices.

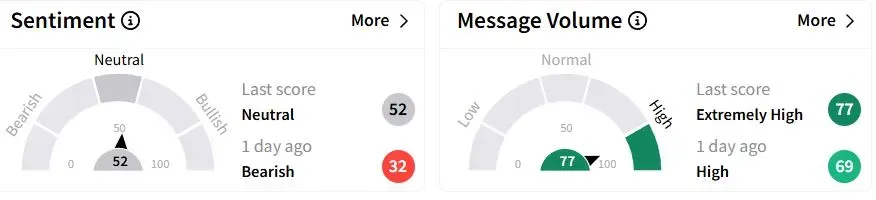

Retail sentiment on Stocktwits moved to ‘neutral’ (52/100) territory from ‘neutral’(53/100) a day ago, while retail chatter remained ‘neutral.’

One retail trader speculated whether Warren Buffett’s Berkshire Hathaway is buying more of the company’s shares.

Another trader raised concerns about whether Buffett can bail the company out if energy prices continue to fall.

Occidental shares have fallen 22.7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)