Advertisement|Remove ads.

October Inflation Inches Higher But Stays In Line With Expectations: Fed’s Kashkari Says CPI Heading In Right Direction

U.S. inflation witnessed an uptick in October but still remained in line with Wall Street estimates. According to the Bureau of Labor Statistics, the consumer price index (CPI) increased 0.2% on a seasonally adjusted basis in October, recording the same increase as in each of the previous three months.

The 12-month inflation rate rose 2.6%, 0.2 percentage points higher than September, partly due to the base effect, i.e. lower inflation a year ago. Meanwhile, core CPI, which excludes food and energy, rose 0.3% in October and gained 3.3% for the 12-month period.

Notably, the headline CPI has increased 0.2% for the fourth straight month while the core CPI has risen 0.3% for the third consecutive month.

The shelter index increased 4.9% over the last year, accounting for over 65% of the total 12-month increase in the core CPI. But a decrease in energy prices helped keep the headline CPI lower than the core CPI.

Following the release of the inflation data, the White House said in a statement that it has been a hard-fought recovery, but the Biden administration is making progress for working families. “We will keep fighting to lower costs for families on key items like housing and health care, and against policies that would undermine our progress on bringing inflation down,” the administration said.

Soon after the release of the inflation data, Federal Reserve Bank of Minneapolis President Neel Kashkari reportedly said that inflation is heading in the right direction toward the central bank’s 2% target.

“We know that housing inflation is a lagging indicator. We know that it takes a couple of years for the new leases to turn over and the new leases are showing that we are headed in the right direction. So, right now, I think that inflation is headed in the right direction,” he said, according to Bloomberg.

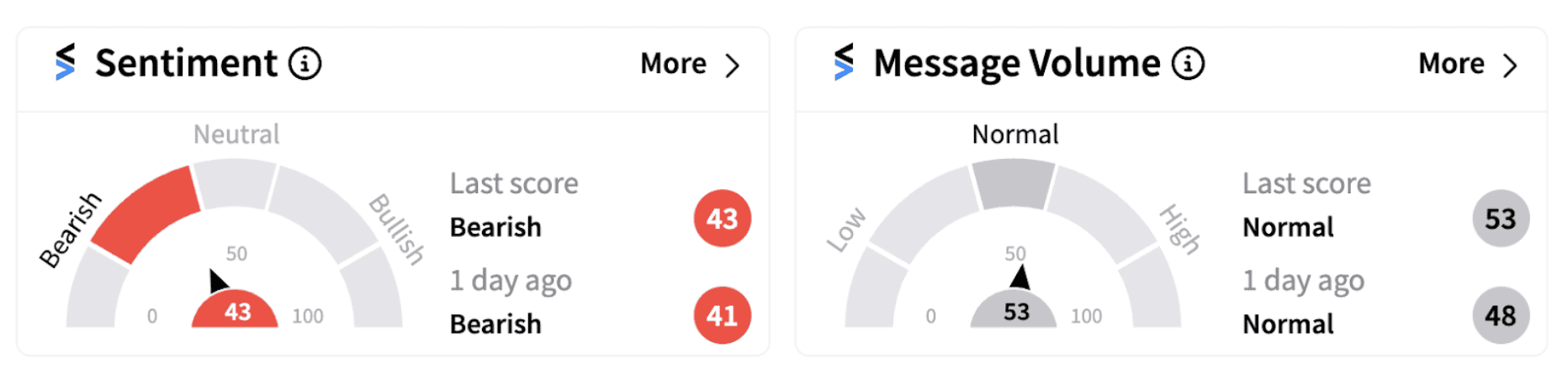

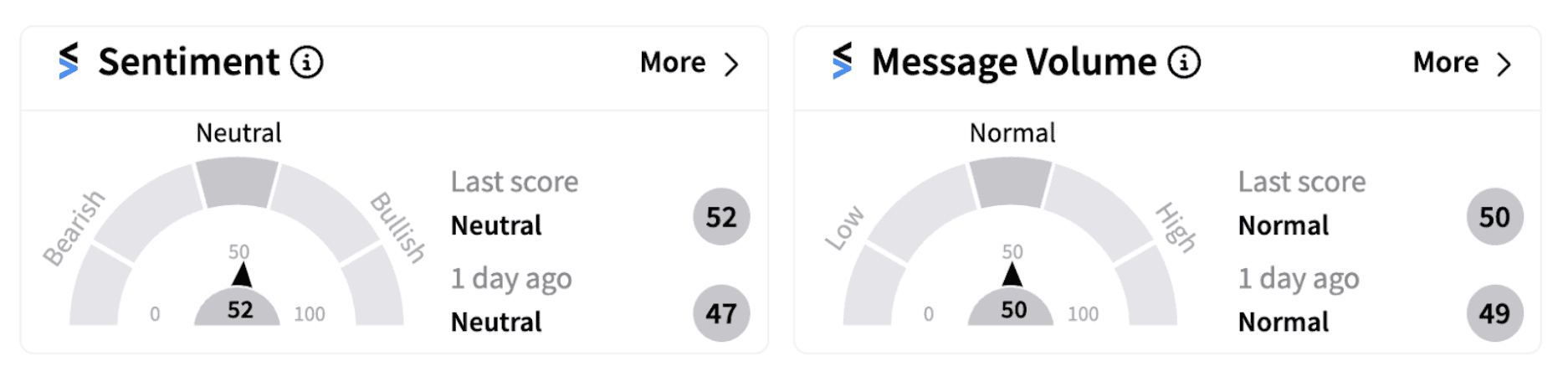

Following the release of inflation numbers, the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) were trading in the red on Wednesday morning.

Also See: Spotify Strikes A Chord As Stock Jumps On Upbeat Q4 Forecast: Retail Tunes In Cheerfully

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)