Advertisement|Remove ads.

Oklo Stock Logs Worst Day In Over 2 Months — But Goldman Sachs Sees Support For Elevated Valuation

Oklo stock (OKLO) snapped a four-session winning streak and logged its biggest single-day percentage decline in over two months on Wednesday.

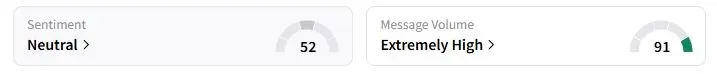

The stock fell by over 8% after Seaport Research downgraded the stock due to valuation concerns. Retail sentiment on Stocktwits regarding Oklo shifted to ‘neutral’ territory from ‘bullish’ a day ago, while retail chatter remained ‘extremely high.’

The downgrade came after Oklo, a small-scale advanced nuclear reactor developer, broke ground on Monday at Idaho National Laboratory (INL) for its inaugural Aurora powerhouse reactor. The site, called Aurora-INL, is part of the U.S. Department of Energy’s newly launched Reactor Pilot Program, which aims to fast-track nuclear deployment amid soaring demand for electricity driven by artificial intelligence data centers.

The stock has already seen a fivefold increase this year, giving it a valuation of over $19 billion, more than three times the market capitalization of rival NuScale Power, which is developing its own advanced reactor. However, unlike NuScale, Oklo does not yet hold a design approval from the Nuclear Regulatory Commission.

“Many people expect a bounce at $100, but this could be sold down to $20 or $30 as long as the company is unable to get an application submitted for review at NRC,” one Stocktwits user wrote.

Separately, Democratic Senator Ed Markey of Massachusetts sent a letter to President Donald Trump on Tuesday, alleging that U.S. Energy Secretary Chris Wright might be working in favor of the company, where he held a board position until his appointment to the Trump Cabinet.

“I am concerned that your Administration is moving forward with plans to transfer plutonium to Oklo and allow it to build a reprocessing plant, not because these proposals make sense for the United States, but because Oklo stands to benefit financially, and Secretary Wright is acting in his former company’s interest,” Markey wrote in the letter.

However, Goldman Sachs analysts initiated coverage of the stock with a ‘Neutral’ rating on Wednesday and gave it a price target of $117, which implies a 10.8% downside compared to the stock’s last closing price.

According to The Fly, Goldman analysts noted that Oklo is uniquely pursuing an own-and-operate model, which provides more operational control for the firm but also comes with much greater financial risks and "considerable capital intensity."

However, the firm sees a catalyst-rich backdrop supporting the stock's elevated valuation levels in the near to medium term.

Also See: Why Did Transocean Stock Fall Over 12% After-Hours Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)