Advertisement|Remove ads.

Why Did Transocean Stock Fall Over 12% After-Hours Today?

Transocean (RIG) stock fell 12.9% in extended trading on Wednesday after the company announced a public offering of 100 million shares.

Citigroup and Morgan Stanley are the joint book-running managers for the offering, the offshore drilling firm said. The company also expects to grant the underwriters a 30-day option to buy up to an additional 15 million shares in the offering.

The Switzerland-based company expects to spend a significant portion of the proceeds on debt repayment, including the repayment of a portion of the $655 million aggregate principal amount of a bond issued by Transocean International Ltd, a wholly owned unit.

Earlier this year, the company unveiled a goal to reduce $700 million in debt by year-end. Its long-term debt stood at $5.89 billion as of June 30.

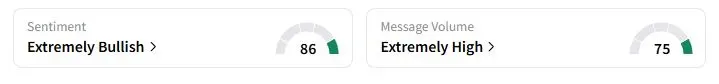

Retail sentiment on Stocktwits about Transocean was in the ‘extremely bullish’ territory at the time of writing, while retail chatter was ‘extremely high.’

One Stocktwits user noted that it does make sense to pay off the highest interest debts via issuing new shares, since U.S. interest rates will “consecutively decline over the next quarters.”

However, another user replied, “Generally, you want to issue shares when the stock is overvalued, not undervalued, like we are. And companies should buy back shares when [the] share price is cheap to accrue more equity for shareholders.”

During the second quarter, the company’s contract drilling revenue increased sequentially by $82 million to $988 million, primarily due to higher revenues associated with improved rig utilization and cost reductions.

Energy firms are seeking to rein in costs amid ongoing downward pressure on oil prices, driven by concerns about oversupply. Most firms estimate crude oil prices will slip below $60 per barrel by the end of the year, making it unsustainable for most oil and gas producers to invest in new projects.

Transocean stock has fallen 5.2% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)