Advertisement|Remove ads.

Opendoor Likely To Post Worst Revenue Drop In 2 Years — But Retail Traders Only Care About 'Future Plans'

- Opendoor was the top trending ticker on Stocktwits as of early Thursday.

- The real estate services company at the center of this season's "meme stock" buzz will report its Q3 results after the market closes.

- Analysts expect OPEN to report a 36% decline in revenue to $882.3 million.

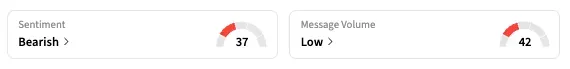

Opendoor Technologies, Inc.'s stock was the top-trending ticker on Stocktwits early Thursday, though it faced 'bearish' sentiment, ahead of the company's quarterly report.

The company, which has been at the forefront of this season's "meme stock" wave, now faces another opportunity to prove to investors who fueled its rally that its fundamentals are catching up. If not, the stock could see a sharp pullback, just as it did after the soft Q2 results in August.

For the third quarter, analysts expect the real estate services company to report a 36% decline in revenue to $882.3 million, its steepest drop since the first quarter of 2024, according to Koyfin. Adjusted loss is expected to be $0.07 per share.

What Does Recent Share Performance Say?

Shares of the company have mainly moved sideways over the past two months, reflecting a cautious mood among investors. Even so, the stock remains about ten times higher than its mid-July level of $0.70, when the rally first began to take off. Notably, short interest is down just a percentage point from its mid-September peak to 21.90% as of Wednesday.

Last month, Morgan Stanley raised its price target on OPEN to $2 from $6 and reiterated its 'Market Perform' rating. "While we see limited fundamental justification for OPEN's recent outperformance, we also see the opportunity for a pivot back to home-buying (and significant operating leverage) should there be a stronger housing market recovery," the firm's analysts said in an investor note.

In terms of the stock price, they noted that "similar situations with other stocks have shown that higher valuations are not only often more sustainable than expected, but also create the opportunity for companies to raise capital and address challenges with the support of an enthusiastic shareholder base."

Currently, five of the nine analysts covering OPEN's stock have a 'Hold' rating, three have 'Sell' or lower, and one rates it 'Strong Buy,' according to Koyfin data. Their average price target of $18.7 implies a whopping 70% downside from the stock's last close.

What Is Retail Investors' View?

On Stocktwits, the retail sentiment has remained 'bearish' since the last of this month. One user said that fundamental performance might have a lesser bearing on the stock than it does for a typical company.

"Q3 results are of almost no consequence. What matters is forward guidance and the roadmap. You really think Kaz and co. won't say some of the major buzzwords and present compelling strategies going forward?" said this user.

Opendoor CEO Kaz Nejatian and board chair Keith Rabois have been quite active on X in recent months, frequently discussing company strategy and responding to user questions.

"All I care about are announcements and plans!" another Stocktwits user posted.

Year-to-date, OPEN stock has soared 352%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_rig_bfbf070c8b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1473343393_1_jpg_536dff4c41.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247675651_jpg_f78879cce2.webp)