Advertisement|Remove ads.

Nvidia’s Jensen Huang Holds Out Hope For Blackwell Chip Sales To China: Why It Matters?

- At the GTC conference in Washington, Huang disclosed that Nvidia has a $500 billion revenue backlog from Blackwell and Rubin through 2026.

- U.S. President Donald Trump kept the issue of Blackwell chip out in the meeting with his Chinese counterpart, Xi Jinping.

- The Blackwell models exceed the capabilities of Chinese alternatives from Huawei Technologies Co.

NVIDIA Corp. (NVDA) Chief Executive Officer Jensen Huang has reportedly stated that he remains optimistic about eventually selling the company’s new Blackwell AI chips in China, despite no such plans currently being underway.

Huang’s hopeful statement comes even as U.S. President Donald Trump kept the issue of Blackwell chip out in the meeting with his Chinese counterpart, Xi Jinping, earlier this week.

Why is the Blackwell Chip Sale Important?

In his keynote address at the GTC conference in Washington, Huang disclosed that Nvidia has a $500 billion in Blackwell and Rubin revenue backlog through 2026. A green flag for China sales would mean a significant jump in the chip giant’s revenue backlog.

Currently, H20 is Nvidia’s only approved product for China. The company has also developed a new chip, B30A, a watered-down version of its flagship B300, to qualify for export to the Chinese market.

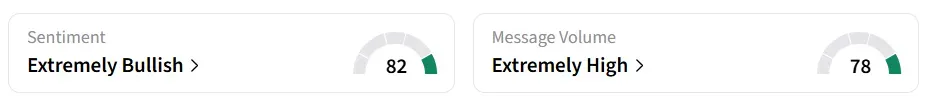

Nvidia stock traded over 2% higher in Friday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

New Generation of AI Power

According to a Bloomberg report, the Blackwell family represents Nvidia’s most advanced line of AI chips, which set the benchmark for training and running large language models, such as OpenAI’s ChatGPT.

These chips outperform earlier models, which were restricted by U.S. export bans, and far exceed the capabilities of Chinese alternatives from Huawei Technologies Co., as cited in the report.

A nod for Blackwell’s sale to China would represent a major shift from the Trump administration’s existing export policy, which aims to block advanced AI technology from reaching key competitors.

NVIDIA's stock has gained over 52% in the last 12 months.

Also See: Castellum Lands Second-Largest Contract In History, Stock Rockets 40% In Pre-Market

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1157193929_jpg_57df32610c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_32b8924ac2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261448901_jpg_dec7c2c9b9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)