Advertisement|Remove ads.

Why Is OSCR Stock Rising Today?

- Oscar Health’s Q4 total revenue came in at $2.81 billion, below estimates of $3.12 billion, according to Fiscal.ai data.

- The company’s medical loss ratio was 95.1% compared to 88.1% last year.

- Oscar Health expects to return to profitability in 2026, eyeing earnings from operations in the range of $250 million to $450 million.

Oscar Health (OSCR) shares traded nearly 5% higher on Tuesday morning after the company projected fiscal 2026 revenue well above the FY2025 level reported alongside its fourth-quarter results.

Q4 Snapshot

The company forecast fiscal 2026 revenue between $18.7 billion and $19 billion, compared with $11.70 billion in fiscal 2025. However, the health insurer’s fourth-quarter (Q4) total revenue came in at $2.81 billion, significantly below the Street estimates of $3.12 billion, according to Fiscal.ai data. Oscar also reported a loss of $1.24 per share, wider than the estimates of a loss of $0.92 per share.

The company’s medical loss ratio (MLR) was 95.1%, meaning 95.1% of total premiums paid by policyholders went toward claims, with the remaining 4.9% retained by the insurer. It was 88.1% last year.

As of Feb. 1, 2026, Oscar served about 3.4 million members.

Firm Eyes Profitability In 2026

CFO Scott Blackley said in a call with analysts that the firm expects to meaningfully improve financial performance and return to profitability in 2026.

“We expect earnings from operations to be in the range of $250 million to $450 million, a significant improvement of nearly $750 million year-over-year, implying an operating margin of approximately 1.9% at the midpoint. Adjusted EBITDA is expected to be approximately $115 million higher than earnings from operations,” Blackley said.

Oscar Health posted a net loss in five of the last six quarters, according to Koyfin data.

On February 6, the company secured a $475 million, three-year revolving credit facility, which Blackley said will provide flexibility to support long-term growth and expand adoption in the individual market.

How Did Stocktwits Users React?

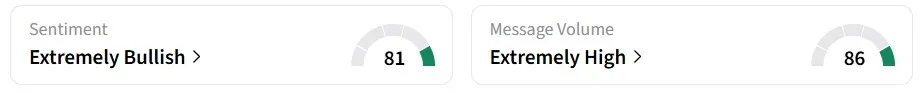

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ a day back, amid ‘extremely high’ message volumes. OSCR was among the top trending tickers at the time of writing.

One user was bullish about the guidance, expecting the stock price to double over the coming weeks.

Another user highlighted that they are adding to their position.

Year-to-date, the stock has declined around 10%

Read also: SIDU Stock Gained 5% In Pre-Market Today – What Is The Deal With Simera Sense About?

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049107660_jpg_906b4acd1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203496924_jpg_18e024f0e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2195819624_jpg_841341254c.webp)