Advertisement|Remove ads.

Palantir Crushed Nvidia, Microsoft And Most AI Stocks In 2025 — And Investors Didn’t Care About Valuation

- Palantir is on track to finish the year among the S&P 500’s top gainers, with shares up nearly 150% year to date.

- Strong revenue growth, expanding margins, and a high Rule of 40 score underscore solid underlying fundamentals.

- Valuation remains the central concern, with the stock trading at a steep premium to the broader market and peers.

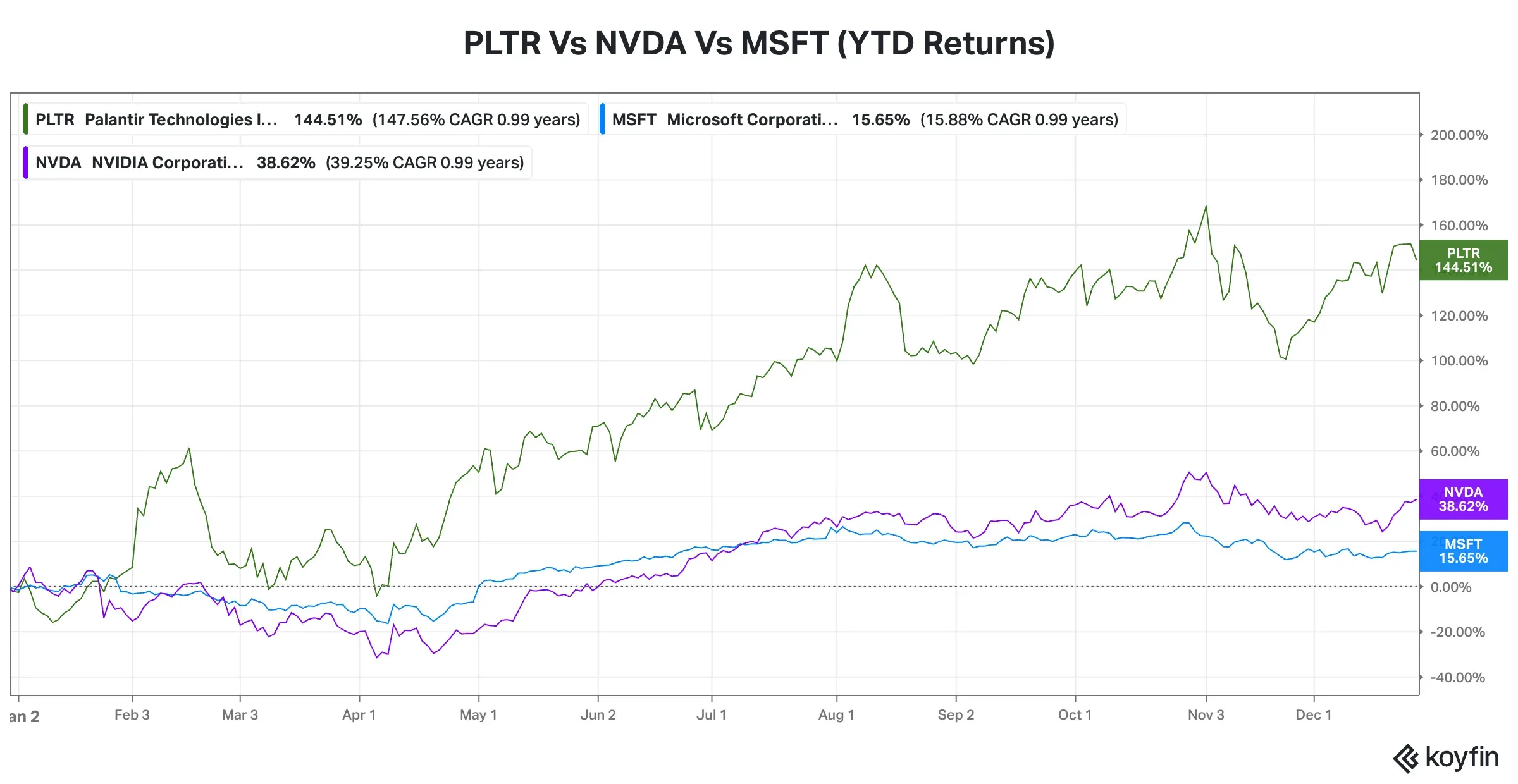

Even as analysts and investors remain divided, Palantir Technologies Inc. (PLTR) is poised to end the year as one of the S&P 500’s top 10 performing stocks. The artificial intelligence (AI)–powered data analytics platform delivered a fundamentally strong year, though valuation concerns remained a persistent red flag as the stock climbed nearly 150% year to date.

As the stock climbed largely unabated—aside from the April tariff-driven market selloff and the November AI pullback—short sellers seized on Palantir’s rally to highlight what they viewed as excessive valuation.

Citron’s Andrew Left argued that Palantir’s stock was worth only about $40—even under generous valuation assumptions—when it was trading above $170.

Palantir — Investors’ Delight?

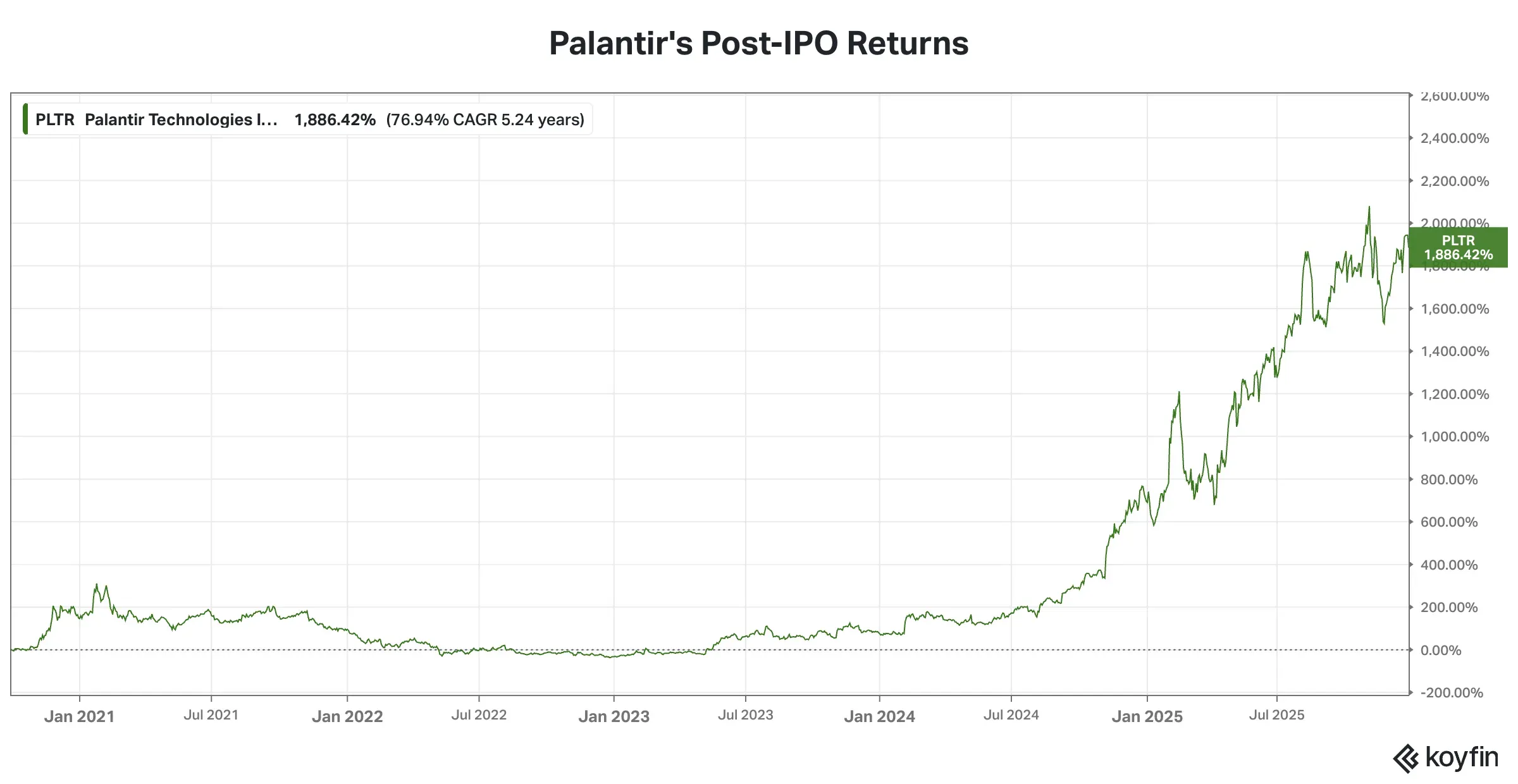

Since Palantir, co-founded by five technocrats, including PayPal cofounder Peter Thiel and current CEO Alex Karp, went public via a direct listing on Sept. 30, 2020, its stock has generated an astounding return of nearly 1,900% for its investors.

Source: Koyfin

Source: Koyfin

The stock was consolidating within a broad range until the middle of 2023, when the rising tide of AI lifted all boats. It has left behind Nvidia, considered the frontrunner in the AI race, and the software giant Microsoft, both of which are biting the dust.

Source: Koyfin

Source: Koyfin

Analysts, Retail Downbeat

When the stock hasn’t disappointed investors, why is there so much pushback from some quarters? Citron’s Left, for one, sees Palantir’s business model as unattractive.

“Palantir relies on large, long-term government contracts and competes in the enterprise space with lumpy, less scalable revenue.”

Given that Palantir is heavily reliant on government contracts, Citron sees software giants posing a long-term competitive threat. The firm also viewed Palantir’s insider sales as a bad omen. According to Quiver Quantitative, Palantir insiders have traded the stock in the open market 337 times in the past six months, all of which were sell trades. Karp alone had sold an estimated $128.78 million of Palantir shares in the same period.

Come November, “Big Short” fame Michael Burry revealed a huge bearish bet on Palantir.

Sell-side analysts are primarily on the sidelines. According to Koyfin, 17 of the 23 analysts covering the stock have a ‘Hold’ rating. Of the remaining analysts, three each have bullish and bearish ratings. The average analyst price target for Palantir’s stock is $186.81, implying just about 1% downside potential.

On Stocktwits, retail traders who were bullish six months ago and three months ago turned ‘neutral’ a week ago. Sentiment downshifted to ‘bearish’ in the recent week.

Palantir is the 13th-most widely followed stock on Stocktwits, with the following count rising 17% over the past year.

Is Pessimism Justified?

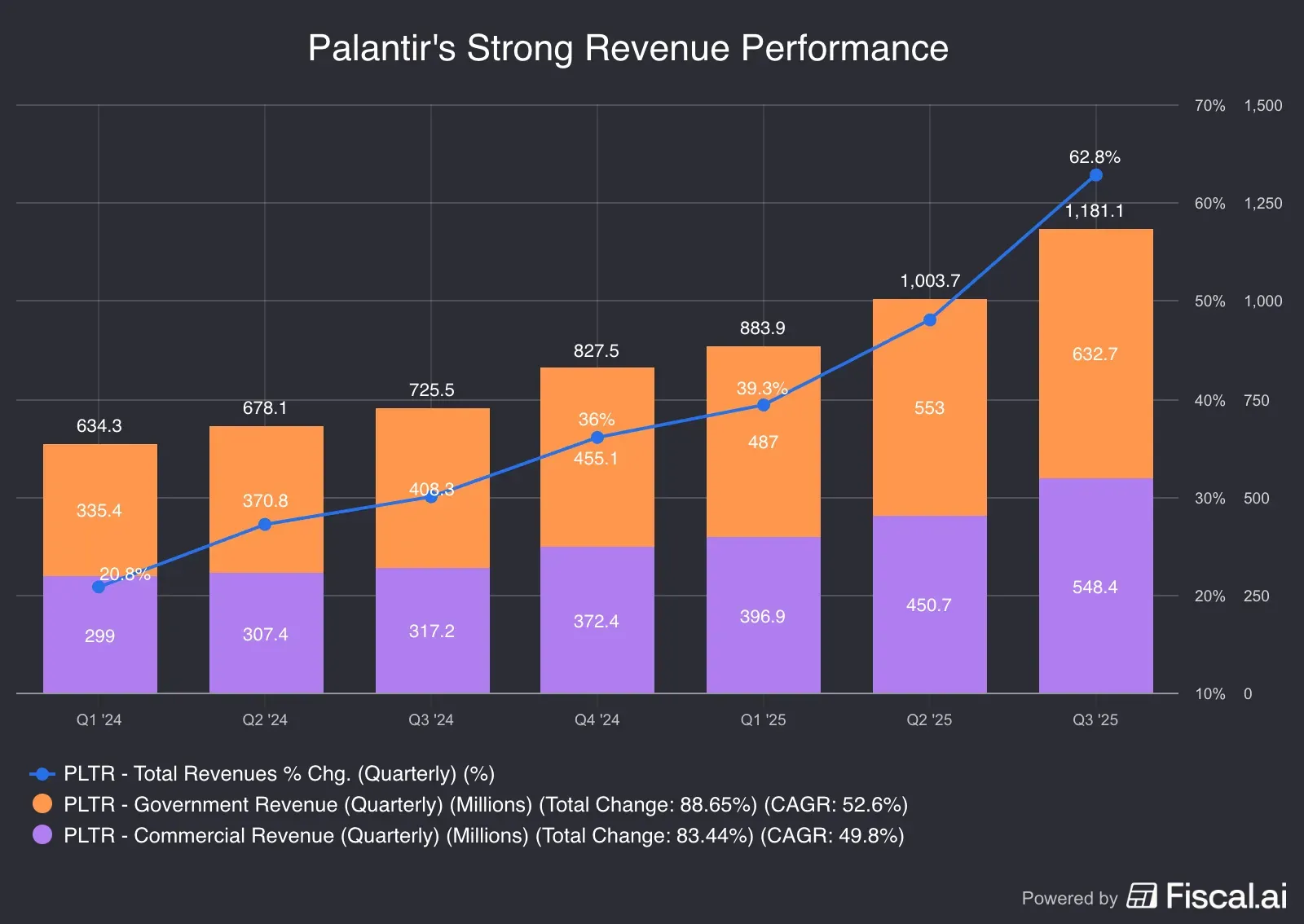

Palantir has been showing both year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth, with the YoY rate accelerating strongly.

Source: Fiscal.ai

The company has aced the “Rule of 40,” a metric that combines revenue growth rate and profit margin. To be considered healthy, a software-as-a-service (SaaS) company should score more than 40%. In the September quarter, the Rule of 40 score was 114% for Palantir.

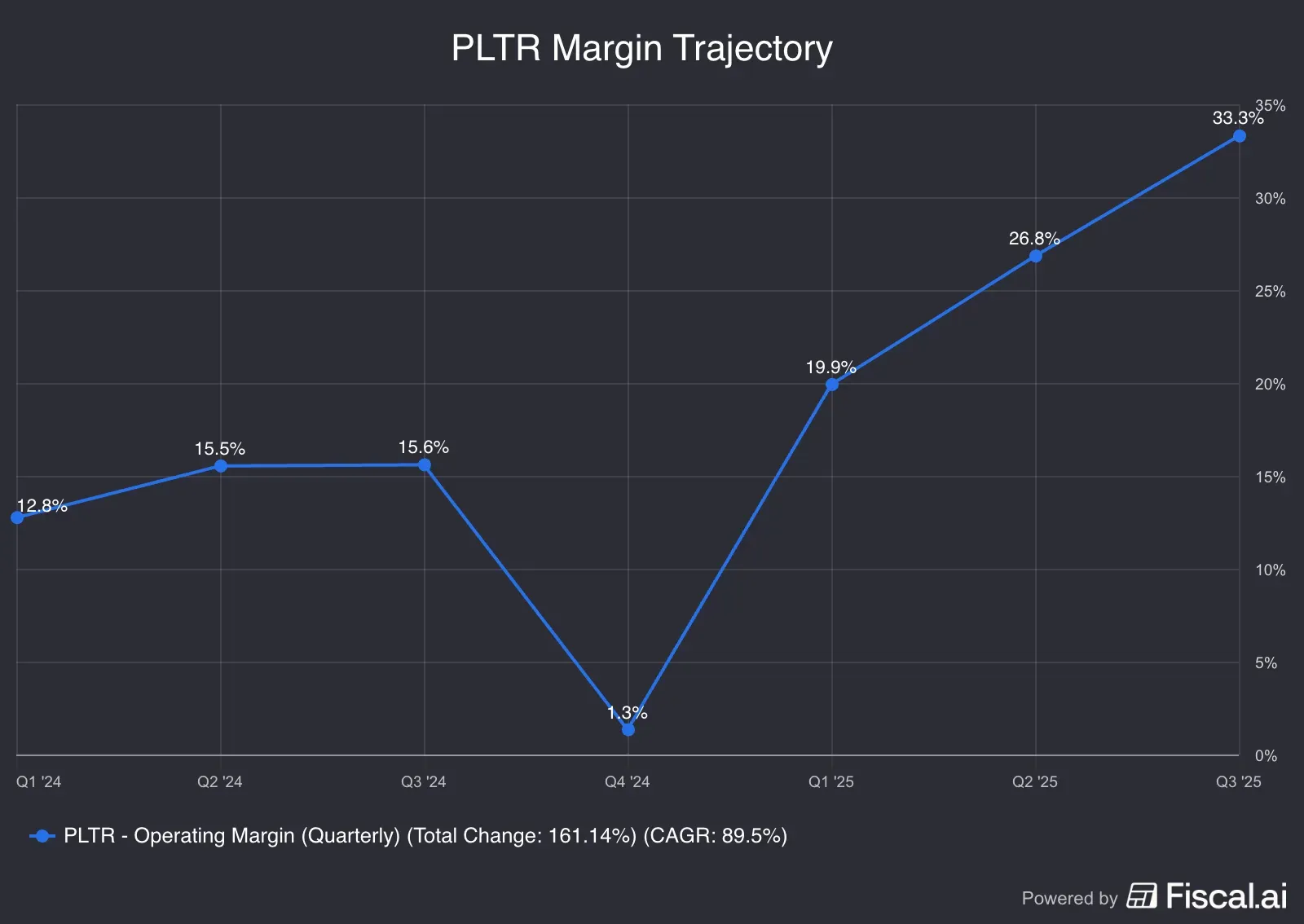

Margins have also been expanding, indicating operational efficiency.

Source: Koyfin

The company announced a raft of partnerships this year, including with the North Atlantic Treaty Organization (NATO) and the U.S. Navy, and companies such as Nvidia Databricks, Anthropic, Archer Aviation, Snowflake, Accenture and xAI.

Most bears see the hefty valuation as a deterrent. The forward price-earnings (P/E) multiple is at a hefty 203.35 compared to the S&P 500’s 22.5 and the IT sector’s 27.1.

While announcing an upward adjustment to Palantir’s stock price target to $170 from $125 in mid-November, Freedom Capital analysts said the embedded hypergrowth, implied by the elevated valuation, is unlikely to persist indefinitely, the Fly reported.

Some retail traders on Stocktwits also lamented the hefty valuation. “Way overpriced,” a retail watcher said. Another user called the stock rally a “manipulated” move.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: IREN Vs Nebius: Which Neocloud Stock Is A Better Bet Heading Into 2026?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)