Advertisement|Remove ads.

This Chipmaker Got A Price Target Hike From UBS Ahead Of Q2 Earnings: Here’s Why Retail’s Excited

UBS has lifted its price target for Advanced Micro Devices Inc. (AMD), citing optimism about the chipmaker’s second-quarter (Q2) performance.

The firm raised its target to $210, up from $150, while maintaining a ‘Buy’ rating on the stock, as per TheFly.

Following the increase, AMD stock traded over 2% higher on Monday’s premarket.

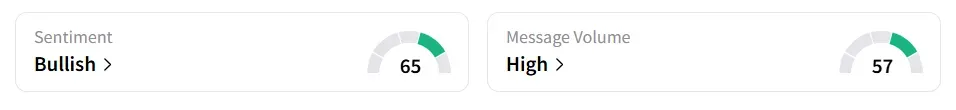

On Stocktwits, retail sentiment toward the stock remained in ‘bullish’ (65/100) territory amid ‘high’(57/100) message volume levels. The message count increased by 136% in the last 24 hours.

A Stocktwits user lauded the price target hike.

Another user was excited about the upcoming earnings.

The updated forecast reflects UBS’s belief that AMD could outperform expectations in both its PC (personal computer) and server segments.

Additionally, the brokerage anticipates the company’s upcoming guidance may exceed market consensus.

The bullish view reflects confidence in AMD’s near-term growth, particularly as the company continues to gain traction in high-performance computing and the enterprise server market.

There is a broader trend of growing investor interest in semiconductor companies, especially those providing infrastructure for AI applications.

President Donald Trump approved three executive directives on July 23, as part of a strategy to speed up artificial intelligence progress and strengthen the U.S.’s leadership in the global AI landscape.

During an AI-focused summit, Trump authorized the measures aimed at reducing regulatory barriers, advancing AI infrastructure, and encouraging the widespread use of U.S.-developed AI technologies.

According to a Bloomberg report, AMD CEO Lisa Su has expressed support for collaboration between the government and the private sector, noting her appreciation for the fact that AI remains a key focus for the administration.

The company is expected to report Q2 earnings on August 5. AMD anticipates $7.40 billion in revenue, compared to a Wall Street estimate of $7.43 billion, according to Fiscal AI data. Analysts expect the company’s Q2 earnings per share (EPS) to be $0.48.

AMD stock has gained over 37% in 2025 and over 19% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)