Advertisement|Remove ads.

PDD Stock Tumbles After Trump Tariff Hike On Low-Cost Chinese Imports: Retail Buzz Intensifies

PDD Holdings, Inc. (PDD) U.S. shares slid on Tuesday and chatter about the stock on Stocktwits spiked early Wednesday after President Donald Trump tripled levies on low-cost imports from China.

Shares dropped 3.5% to $90.70 in after-hours trading on Tuesday after losing 6% in the regular session.

The move will hurt retail businesses in the United States, including Chinese e-commerce platforms Temu, owned by PDD, and Shein, which have grown by shipping cheap goods duty-free to American customers.

Last week, Trump scrapped the "de minimis" exemption for goods from China and Hong Kong and announced a tariff rate of 30%, or $25, on packages worth or less than $800, effective May 2.

On Tuesday, the U.S. bumped the rate to 90% or $75, which will rise to $150 after June 1, on shipments of goods of that value from China, according to a White House notification.

The number of shipments entering the U.S. through the duty-free route has exploded recently, reaching nearly 1.4 billion packages last year.

The government said the latest move was in response to additional levies imposed by China.

The Asian country was already facing a 34% tariff hike scheduled for Wednesday under Trump's "reciprocal" tariff strategy. However, after Beijing stuck to its plan to levy 34% retaliatory tariffs on U.S. products by noon Tuesday, the president responded by adding another 50%, bringing the total new duties to 84%.

Earlier on Tuesday, China's Commerce Ministry said it "firmly opposes" the additional 50% tariffs on Chinese imports, calling it "a mistake upon a mistake."

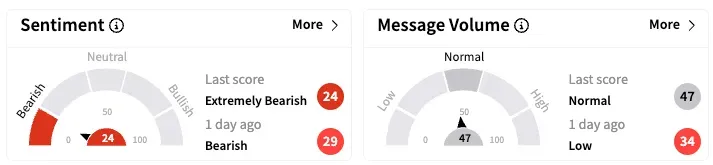

On Stocktwits, retail sentiment for PDD was 'bearish', while message volume jumped by 110% in the past 24 hours.

Users said Trump's policies are essentially "destroying the stock", and expected it to fall to $70 this week.

PDD Holdings' co-CEO Chen Lei told analysts last month to expect "challenges" for its global business, adding that PDD's response includes exploring new business models and experimenting with "innovative localized supply chain solutions."

PDD shares in the U.S. have shed 0.4% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_85ede3fab5.webp)