Advertisement|Remove ads.

PepsiCo Raises Dividend Despite Recent Cut To 2025 Profit View: Retail Turns Bullish

PepsiCo (PEP) raised its quarterly dividend by 5% on Tuesday in a likely effort to maintain the appeal of its shares amid a slide in their value due to weakness in its food and drinks business.

The move comes despite the beverage giant cutting its annual profit forecast recently.

Pepsi has set the dividend at $1.4225 per share, up from $1.355 previously, and will pay it to shareholders on June 30, it said in an exchange filing.

That totals an annual dividend of $5.69 per share, up from $5.42.

Investors typically gravitate to dividend-paying stocks during periods of economic uncertainty and stock market volatility. PepsiCo has been paying shareholders dividends for five decades.

In its earnings report last month, PepsiCo maintained its annual revenue outlook and cut its bottom-line expectation.

It expects core constant currency earnings per share (EPS) to be roughly flat from the prior year, down from a previous forecast calling for mid-single-digit growth.

Accounting for foreign exchange translation, this implies a 3% decline in core EPS year over year.

For several quarters, PepsiCo has struggled due to competition with Keurig Dr Pepper (KDP) sodas and weakness in its own Frito-Lay snacks division.

Meanwhile, the U.S. food regulator is pushing food companies to phase out artificial colorants in food items by next year, which will affect several firms, including PepsiCo.

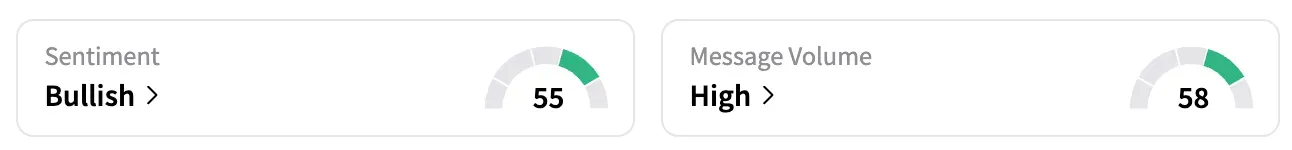

On Stocktwits, retail sentiment jumped to 'bullish' from 'neutral', and message volume jumped to 'high'.

One user said, "grab it with both hands."

Another user criticized health secretary Robert F. Kennedy's stance against soda companies, saying PepsiCo is a snack food conglomerate that is "expanding globally more and more each and every year."

They added that the stock, down over 30% from all-time highs, is attractive for a long-term hold if investors can "overlook the short-term headwinds."

PepsiCo stock is down 14% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)