Advertisement|Remove ads.

Peter Schiff Warns Most People Are 'Clueless' And In For A 'Shock' As Gold, Silver Scale New Highs: SLV, GLD ETFs Soar Pre-Market

- Spot silver prices touched a new high of $110 per troy ounce, rising more than 6% over the previous day.

- Spot gold prices also rose, climbing to a new high of $5,111 per troy ounce, gaining more than 2%.

- Analysts at ING Think point to heightened policy uncertainty and a weaker U.S. dollar as the factors fueling the surge in silver prices.

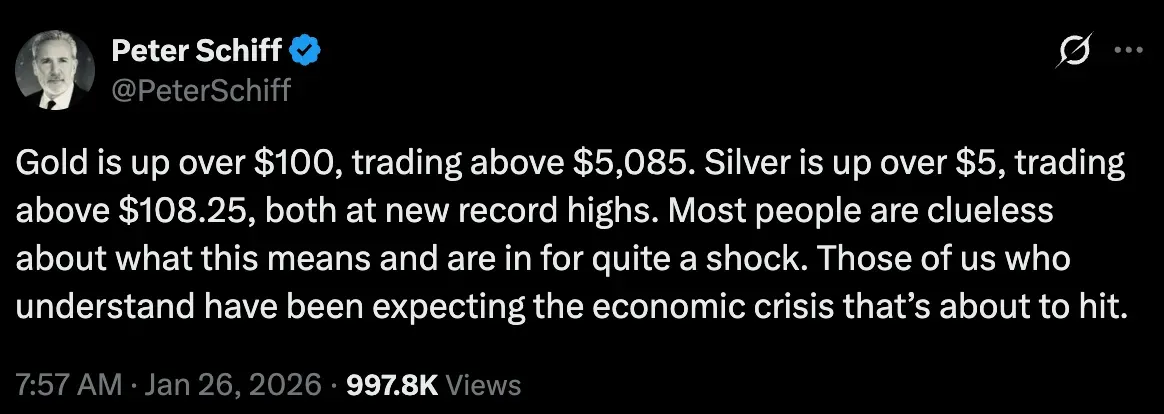

Economist Peter Schiff on Monday warned of an imminent economic crisis after gold smashed past $5,000 and silver crossed $100 per troy ounce.

“Most people are clueless about what this means and are in for quite a shock,” the economist said in a post on X.

Schiff’s post comes amid a searing rally in the two precious metals. Spot gold prices have surged nearly 18% year-to-date, while spot silver prices have gained more than 54% during this period.

Spot silver prices touched a new high of $110 per troy ounce, rising more than 6% over the previous day. Silver futures maturing in March rose by nearly 8% to $110.06.

Spot gold prices also rose, climbing to a new high of $5,111 per troy ounce, gaining more than 2%. Gold futures maturing in February gained 2% to rise to $5,080.

Why Is Silver Rallying?

Analysts at ING Think point to heightened policy uncertainty and a weaker U.S. dollar as the factors fueling the surge in silver prices. “A weaker dollar, lower real yields, and persistent policy uncertainty have reinforced investor appetite for hard assets,” the firm stated in a Monday note.

ING Think also noted that the surge in silver prices reflects its resilient safe-haven status and robust industrial demand for the metal.

The firm added that with the gold-silver ratio now just above 50, its lowest level since 2011, the smaller market size for silver and its dual use as both an industrial and an investment metal have amplified the volatility in its prices.

Adding to the concerns is the probability of another U.S. federal government shutdown. The odds of a shutdown this Saturday are currently at 77%, according to bets on prediction market Kalshi.

Where Are Gold Prices Headed?

Mohamed El-Erian, Chief Economic Advisor at Allianz, chimed in on the surge in gold prices, stating in a post on X that the yellow metal could now hit $6,000 per troy ounce in 2026.

“We are likely to see $6,000 in 2026, though I expect the climb to be a lot more volatile from here,” he said.

Analysts at ING Think added that, despite market volatility, the broader backdrop remains supportive of both gold and silver. The firm cited geopolitical tensions, central bank buying, and structural supply deficits for both metals as the reasons behind its positive outlook for gold and silver.

The iShares Silver Trust ETF (SLV) was up 6.66% at the time of writing, while the abrdn Physical Silver Shares ETF (SIVR) was up 6.7%. The SLV and SIVR ETFs have both surged around 35% year-to-date, with retail sentiment on Stocktwits around the SLV ETF trending in the ‘bullish’ territory.

The SPDR Gold Shares ETF (GLD) was up 2.27% at the time of writing, while the iShares Gold Trust ETF (IAU) was up 2.23%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_bear_crash_93b71a2ed3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_global_e_online_jpg_d113293502.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782299_jpg_f1c47d74a6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)