Advertisement|Remove ads.

Pfizer Stock Slips Premarket Despite Completing Metsera Deal; Investors React To BioNTech Stake Cut

- The Metsera buyout brings multiple obesity and cardiometabolic drug candidates into Pfizer’s pipeline, including a GLP-1 nearing Phase 3.

- Pfizer’s BioNTech position was reduced by 54.7%, leaving approximately 1.66 million ADS, as the company prepares for a looming patent cliff.

- Retail sentiment on Stocktwits remained upbeat, citing steady momentum and expectations for further upside.

Pfizer shares fell 0.5% in premarket trading on Friday as investors shrugged off the completion of its Metsera acquisition and assessed the drugmaker’s decision to cut its BioNTech position by more than half.

Pfizer Completes Metsera Buyout

Pfizer closed its acquisition of Metsera for $65.60 per share in cash plus a contingent value right of up to $20.65 per share tied to clinical and regulatory milestones, valuing the transaction at roughly $7 billion excluding milestones. Metsera’s stock will stop trading on the Nasdaq after Friday’s close, and the company will operate as a Pfizer unit.

The deal adds a slate of clinical-stage obesity and cardiometabolic assets to Pfizer’s internal medicine portfolio, including MET-097i, a weekly and monthly injectable GLP-1 receptor agonist set to enter Phase 3, and MET-233i, a monthly amylin analog in early development. The portfolio also includes an oral GLP-1 candidate and several preclinical hormone-based therapies.

Pfizer said the acquisition will be dilutive through 2030 as it increases investment in several late-stage programs.

Pfizer Cuts BioNTech Stake

Pfizer also said that it has reduced its stake in BioNTech by 54.7%, leaving it with about 1.66 million American Depositary Shares valued at roughly $163.5 million as of Sept. 30, according to a Reuters report.

The companies first partnered in 2018 on mRNA flu vaccines and later developed Comirnaty, the world’s first authorized mRNA Covid-19 vaccine, which reached peak annual sales of $37.8 billion in 2022.

BioNTech confirmed the stake sale but said the collaboration between the companies has not changed.

Pipeline Reset Amid Looming Patent Cliff

The stake reduction and the Metsera buyout come as Pfizer seeks to rebuild its pipeline after its pandemic-era windfall. The company used Covid vaccine proceeds to fund a string of acquisitions, including Seagen, Global Blood Therapeutics, and Biohaven, but now faces a patent cliff for several of its best-selling medicines.

Pfizer is focusing on revving up its pipeline as the company targets an additional $20 billion in revenue by 2030.

Stocktwits Sentiment Stays Upbeat

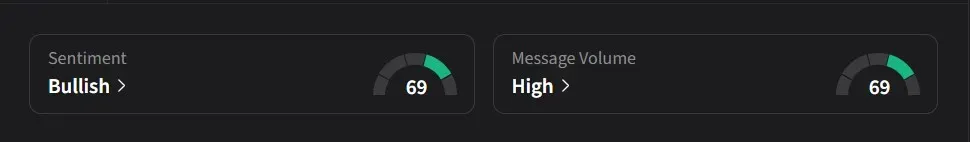

On Stocktwits, retail sentiment for Pfizer was ‘bullish’ amid ‘high’ message volume.

One user said, “whole market goes to shit but PFE quietly keeps moving up and will probably despite all adversity be at 30$ soon making these dividends just so much more enjoyable.“

Another user said, “The ship has been steadied. Going a lot higher.“

Pfizer’s stock has risen 16% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364715_jpg_59427544e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)