Advertisement|Remove ads.

Playa Hotels Stock Surges After Hyatt’s Bid To Buy Hotel Chain For $2.6B: Retail Cheers

Shares of Playa Hotels & Resorts NV ($PLYA) surged more than 2.32% on Monday after Hyatt Hotels Corp ($H) announced an agreement to acquire the former for $2.6 billion, lifting retail sentiment.

Hyatt plans to buy all outstanding shares of Playa Hotels for $13.50 per share, or about $2.6 billion, including about $900 million of debt, net of cash, according to a company statement.

The transaction is expected to return to Playa shareholders a 40% premium to the company's unaffected stock price prior to the disclosure of exclusive discussions with Hyatt, Playa’s chairman and CEO, Bruce D. Wardinski, said in a statement.

The acquisition, expected to close later this year, is subject to closing conditions and regulatory requirements

Playa owns and operates resorts in Mexico, the Dominican Republic, and Jamaica. Hyatt is currently the beneficial owner of 9.4% of Playa’s outstanding shares. Its brands include Hyatt Zilara, Hyatt Ziva, Tapestry Collection by Hilton, Seadust, among others.

"Following a deliberate and comprehensive review of opportunities, the Playa board concluded that the proposed transaction with Hyatt is in the best interest of the company,” Wardinski said. “As a result of our robust process and engagement with a number of potential counterparties, we are confident that this transaction maximizes shareholder value.”

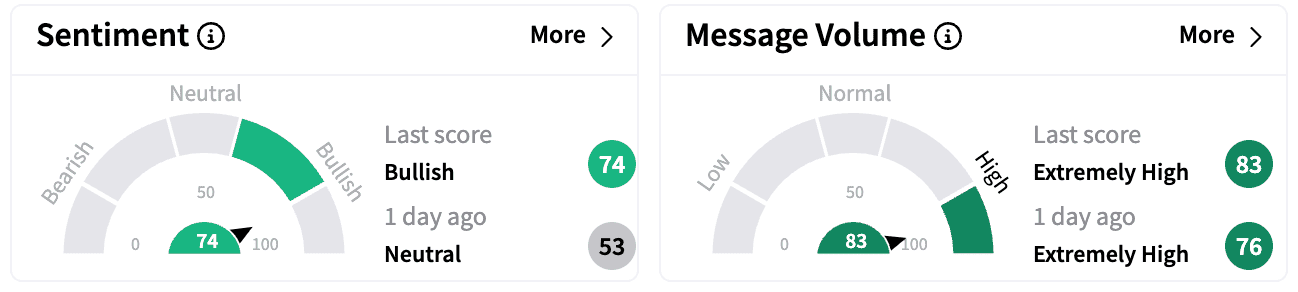

Sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day ago. Message volumes continued to be in the ‘extremely high’ zone.

For its fourth quarter, due later this week, Wall Street analysts expect Hyatt to report $0.73 in earnings per share on estimated revenues of $1.66 billion.

Following the announcement, Oppenheimer analyst Tyler Batory downgraded Playa Hotels to ‘Perform’ from ‘Outperform’ without a price target, Fly.com reported.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)