Advertisement|Remove ads.

Plug Power Tops Q1 Revenue Estimates, Eyes Europe For Growth Amid Threats To Tax Credits: Retail’s Bullish

Plug Power (PLUG) stock drew retail buzz on Monday after the company’s first-quarter revenue topped Wall Street’s estimates.

According to Koyfin data, the hydrogen fuel cell maker reported revenue of $133.7 million for the three months ended March 31, which topped estimates of $131.8 million.

It reported a net loss of $196.9 million, or $0.21 per share, for the first quarter, compared with a loss of $295.8 million, or $0.46 per share, a year earlier.

The company had $295.8 million in unrestricted cash at the end of the first quarter.

Plug expects second-quarter 2025 revenue to range between $140 million and $180 million. Analysts expect it to post $158.6 million.

Plug said there is about $200 million in backlog for electrolyzers this year.

The company also earmarked Europe as the next pivot for growth due to several green hydrogen-friendly policies adopted by lawmakers looking to cut industrial emissions.

“We expect Europe to be a multi-gigawatt contributor to bookings and revenue over the next 18 to 24 months with meaningful margin contribution as projects move from backlog to commissioning,” a company executive said on a call with analysts.

However, uncertainty remains around Plug’s upcoming projects in the U.S., as the Republican-held Congress debates the 45V tax credits for hydrogen projects amid the Trump administration’s push for budget cuts.

CEO Andy Marsh said there is strong support for hydrogen production hubs in Republican-ruled states, and the projects would not be viable without the tax credits.

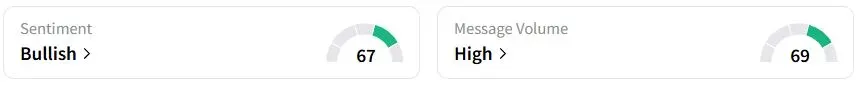

Retail sentiment on Stocktwits was in the ‘bullish’ (67/100) territory, while retail chatter was ‘high.’

One user said that while the company is “not out of the woods,” it is better positioned for significant growth.

Another user said the results showed no real turnaround amid negative margins and continued cash burn.

Plug Power stock has fallen 58.7% year to date (YTD).

Also See: Bakkt Stock Rises After Q1 Profit Swing, Retail Sees ‘Explosive Growth’ After Underperformance

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)