Advertisement|Remove ads.

Prologis Stock Rallies After Q4 Profit More Than Doubles: Retail Shows Admiration

Prologis (PLD) shares rose 5.1% on Tuesday after the real estate investment trust’s (REIT) fourth-quarter profit more than doubled.

The company reported a net income of $1.28 billion, or $1.37 per share, for the three months ended Dec. 31, compared with $629 million, or $0.68 per share in profit, in the year-ago quarter.

The San Francisco-based firm reported core funds from operations (FFO), a metric used to gauge the profitability of REITs, of $1.50 per share, compared with the average analysts' estimate of $1.39 per share, according to FinChat data.

Its fourth-quarter revenue of $2.20 billion topped Wall Street's expectation of $1.94 billion.

"Post-election leasing activity has been strong, and our ongoing conversations with customers support our expectation that the market is nearing an inflection point," said CEO Hamid R. Moghadam in a statement.

Prologis, which has some form of ownership interest in 1.3 billion square feet of property, said its customer retention rose to 78.4% compared with 73.1% in the year-ago quarter.

The company added that its average occupancy stood at 95.8%, slightly below the 97.4% reported last year.

Its earnings also benefited from selling the Chicago-based Elk Grove data center to HMC Capital.

Prologis forecast net earnings in the range of $3.45 per share to $3.70 per share for 2025.

It projected core FFO to be in the range of $5.65 to $5.81 per share.

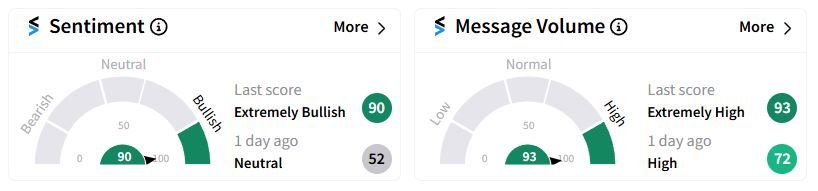

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (90/100) territory from ‘neutral’(52/100) a day ago, hitting the highest level in a year. Retail chatter rose to ‘extremely high’ levels.

One user expressed satisfaction with the performance of the stock.

Over the past year, the stock has lost about 12%.

Also See: KeyCorp Stock Hits 1-Week Low After Swinging To Q4 Loss, Triggers Some Bearish Retail Chatter

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2154063535_jpg_cf31bd3cae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240162060_jpg_8ec666091a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1247757513_jpg_72c3cc4670.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)