Advertisement|Remove ads.

QBTS Rally Shows No Signs of Slowing: Stock Extends Gains After Fresh Peak Even As Quantum Bubble Fears Linger

D-Wave Quantum, Inc. (QBTS) stock rallied over 6% to a new high of $45.30 (intraday) on Tuesday, even as the broader tech sector moved lower, and it rose further in the extended session.

Since breaking out of a recent consolidation phase in late September, D-Wave stock has been on a broader uptrend as traders have become increasingly optimistic regarding the quantum computing industry. Tuesday’s rally came after the company was named as among the recipients of Fast Company’s 2025 Next Big Things in Tech awards.

Commenting on the feat, D-Wave CEO Alan Baratz said, “This award underscores the groundbreaking performance of our Advantage2 annealing quantum computer to efficiently solve highly complex problems that are difficult for classical computers.” “It’s a well-earned testament to D-Wave's relentless delivery of production-ready quantum computing technology that brings value to our customers today.”

Recently, JPMorgan named quantum computing among the 27 industries that it would invest in as part of its 10-year plan to nurture industries that are critical to national and economic security.

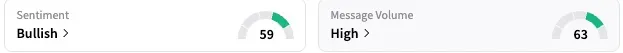

On Stocktwits, retail sentiment toward D-Wave stock improved to ‘bullish’ (59/100) by late Tuesday from ‘neutral’ the day before. The message volume on the stream was ‘high.’ Underlining the increasing interest in the stock in the near past, the message volume on the stream was up about 2,400% over the 30 days leading up to late Tuesday. Over the past year, the stock’s following on the platform increased by 830%.

A bullish watcher predicted a significant move for D-Wave stock, citing strong momentum and reduced volatility that reinforce a bullish outlook. “The stock appears strong but remains high-risk,” they said.

Another user speculated that a short squeeze could be coming. According to Koyfin, short interest in the stock is 18.30%, near the all-time high of over 19% seen in July.

D-Wave stock has gained a whopping 412% so far this year. Wall Street analysts, however, have turned uneasy about the stock’s valuation. The average price target for D-Wave stock is $23.30, according to Koyfin, implying roughly 46% downside from Tuesday’s close.

According to a Barron’s report published last week, quantum computing stocks are trading in bubble territory. The report pointed out that quantum companies Rigetti, IonQ, D-Wave, and Quantum Computing generated about $26 million in sales over three months but command a collective market capitalization of $55 billion.

The skepticism stems from some of the principal challenges these companies face, such as the propensity for errors due to Qubits — fundamental units of information in quantum computing — being sensitive to environmental noise or any other disturbances at the atomic level. The concerns also reflect the time it would take for the technology to become commercially and widely available.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Nasdaq, S&P 500 Futures Edge Higher On Rate-Cut Hopes: Traders Eye More Big Bank Earnings, Fed Talks

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)