Advertisement|Remove ads.

Qualcomm Stock Falls Pre-Market On Arm License Dispute, Yet Retail Sentiment Remains Strong

Qualcomm Inc. ($QCOM) shares dropped by as much as 4% in pre-market trading on Wednesday following reports that Arm Holdings ($ARM) has canceled a crucial architectural license, preventing Qualcomm from using Arm’s intellectual property for chip design.

Arm’s US-listed shares were down by as much as 3% before markets opened on Wednesday.

According to Bloomberg, Arm has issued a 60-day notice, revoking the agreement that allows Qualcomm to create custom chips based on Arm’s technology standards.

Qualcomm, which produces hundreds of millions of processors annually for Android smartphones, could potentially lose the ability to sell products responsible for a significant portion of its $39 billion revenue or face massive damages.

This move escalates a legal battle that began in 2022 when Arm sued Qualcomm for breach of contract and trademark

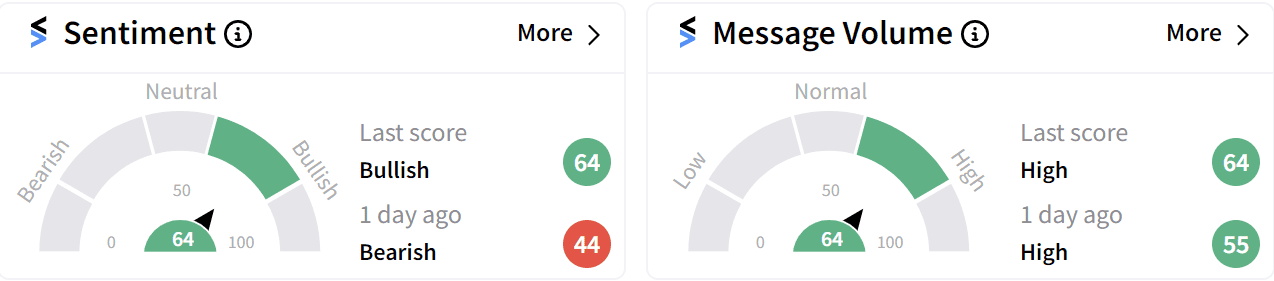

Despite the controversy, retail sentiment on Stocktwits is in the ‘bullish’ (64/100) territory – an uptick from being ‘bearish’ just a day ago.

Under CEO Cristiano Amon, Qualcomm has already started shifting away from Arm’s designs, focusing more on its own development, particularly in computing, where Arm also competes.

Qualcomm, which derives much of its profit from licensing its own technology to major smartphone makers like Samsung and Apple, has navigated similar disputes before.

In 2019, it prevailed in a legal battle with Apple and successfully defended itself against accusations of predatory licensing practices from the U.S. Federal Trade Commission.

Qualcomm’s stock has gained 18% so far in 2024 and 52% in the last 12 months.

For updates and corrections email newsroom@stocktwits.com.

Read more: Starbucks Stock Slips After Preliminary Earnings, 2025 Guidance Suspension: Retail Sentiment Weakens

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_autozone_resized_jpg_8733836467.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)