Advertisement|Remove ads.

RBL Bank Shares In Focus: Board Meeting To Raise Funds, Emirates NBD’s Potential Acquisition Drive Retail Sentiment

RBL Bank has been in the limelight after reports of a potential acquisition by Emirates NBD emerged earlier this week.

Emirates NBD, one of the largest lenders in the Middle East, is reportedly in advanced discussions to acquire a majority stake in the private sector bank. Reports suggest that Emirates NBD is eyeing a 60% stake in RBL Bank, subject to regulatory approvals and a mandatory open offer.

Board Meeting to Raise Funds

After market hours on Wednesday, RBL Bank issued a statement announcing that its board is scheduled to meet on Saturday, October 18, to approve a proposal for raising funds through the issuance of shares, equity-linked instruments, or other eligible securities via preferential issue or private placement. The amount wasn’t disclosed.

RBL Bank's stock gained around 1.7% on Thursday.

How Has The Stock Fared This Year?

Shares of RBL Bank have more than doubled since February this year. The stock has closed higher in seven of the past eight months, marking its strongest sustained rally since listing in 2016.

The turnaround has been due to better asset quality and optimism surrounding a potential majority stake acquisition by Emirates NBD.

The Reserve Bank of India (RBI) has reportedly provided informal approval for the change of control. If completed, the deal would become the largest single foreign direct investment in India’s banking sector.

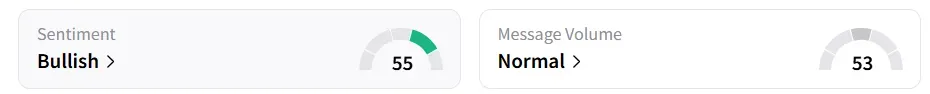

Retail sentiment on Stocktwits has remained ‘bullish’ for a while. It was ‘neutral’ over a month back.

The recent upswing has also pushed RBL Bank shares to their highest levels since March 2020, while bringing year-to-date returns to 90%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)