Advertisement|Remove ads.

RBL Bank Stock Hits 21-Month High On Potential Emirates NBD Stake Deal

Shares of RBL Bank gained as much as 3% on Tuesday following reports that Emirates NBD, one of the largest lenders in the Middle East, is in advanced discussions to acquire a majority stake in the private sector bank.

RBL Bank shares climbed to their highest levels since January 2024.

Emirates NBD Discussions

According to a Moneycontrol report, both parties have been engaged in negotiations for several months, with Emirates NBD keen on purchasing over 51% of RBL Bank. However, the terms of the potential deal are yet to be finalized, and the transaction may or may not materialize.

RBL Bank is fully publicly held, with no promoter entity, and its market capitalization stood at ₹17,786.79 crore as of October 13. A 51% stake at current levels would be valued at roughly ₹9,071 crore.

According to the report, the preferential issue route may be used for the proposed acquisition. If completed, the deal would trigger an open offer and require RBI approval.

Emirates NBD had earlier shown interest in acquiring a stake in IDBI Bank, alongside bidders such as Fairfax, Oaktree, and Kotak Mahindra Bank.

Foreign Interest in Indian Private Sector Lenders

Foreign companies have increased their interest in Indian banks lately. Warburg Pincus recently acquired a 9.99% stake in IDFC First Bank, while Sumitomo Mitsui Banking Corporation received RBI approval to raise its stake in Yes Bank to 24%.

Stock Watch

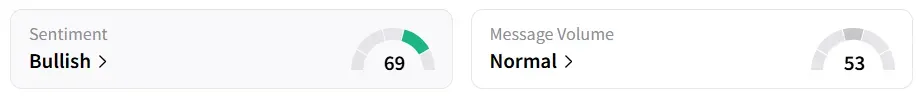

Retail sentiment on Stocktwits has remained ‘bullish’. It was ‘neutral’ last week.

Year-to-date, the stock has seen significant buying interest, gaining more than 85%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Solana_722b6a3879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_X_Elon_Musk_274c6a8683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_o_leary_OG_jpg_2789641a97.webp)