Advertisement|Remove ads.

Reddit Analyst Says Beaten-Down Stock ‘Extremely Attractive’ But Retail Sees No Light At End Of Tunnel

The red-hot rally in Reddit, Inc. (RDDT) stock has cooled off amid the broader market weakness seen since mid-February. However, an analyst considers the recent slump a good buying opportunity.

In a note released Tuesday, Loop Capital analyst Alan Gould said the community-based social networking company’s stock has become “extremely attractive” following its 50% drop in a month, TheFly reported.

Gould expects Reddit’s average revenue per user (ARPU) to be driven by better ad tools, advertising on more surfaces, including a larger ad load on the comments page, and potentially better search advertising. He also sees auction dynamics from bringing more advertisers onto the platform.

The analyst estimates that Reddit's revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) will grow 36% and 87%, respectively, in 2025.

Last week, Reddit announced new content moderation and analytical tools such as “post check,” “post recovery,” and “post insights” to make it easier for users to join conversations and share in communities.

Reddit stock, which was publicly listed on March 21, 2024, ended the year with a gain of 224%. The rally’s momentum accelerated in the new year, and the stock hit a record high of $230.41 (intraday) on Feb.10.

However, it has lost over 53% from the highs.

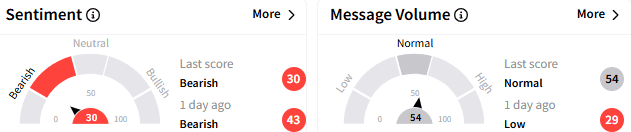

On Stocktwits, the retail sentiment toward Reddit stock stayed ‘bearish’ (30/100), and the message volume, though nudging higher, was at ‘normal’ levels.

Few watchers said the stock could head to $30, blaming the downside on President Donald Trump’s policies.

Another user predicted a further downside due to valuation concerns.

Reddit stock fell nearly 20% on Monday, moving in tandem with tech peers as ongoing concerns over Trump’s tariffs tipping the global economy into a recession intensified.

Although bargain hunting could bring some semblance of sanity, the market could tread waters until it sees off the February consumer price inflation report due Wednesday.

Reddit stock climbed over 11% to $119.28 in early trading.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: IonQ Halts ATM Program After $372M Fund Raise, Stock Rebounds Pre-Market; Retail Doesn't Budge

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)