Advertisement|Remove ads.

Reddit Stock Drops After Wells Fargo Downgrade Amid AI Search Threat: But Retail Stays Optimistic

Reddit Inc (RDDT) shares traded 4.5% lower on Monday after Wells Fargo analyst Ken Gawrelski downgraded the stock to ‘Equal Weight’ from ‘Overweight’ and slashed the price target to $115 from $168.

The analyst suggested that Reddit's recent drop in user activity may represent a lasting trend, driven by shifts in how people search online.

The analyst noted in the research briefing that Google is expected to roll out fully integrated AI-powered search soon, and the impact could extend beyond Reddit to any platform relying heavily on search-driven traffic.

Wells Fargo anticipates further declines in Reddit’s non-logged-in user base as Google ramps up its AI features.

This threat has, therefore, led the analyst to project continued downward pressure on Reddit's valuation multiple due to these user engagement challenges.

Reddit stock has gained 13% in the last month, boosted by better-than-expected first-quarter (Q1) earnings.

The news aggregation platform’s Q1 revenue jumped 61% to $392.3 million, beating the consensus estimate of $369.6 million, as per Finchat data. The daily active uniques (DAUq) recorded a 31% increase.

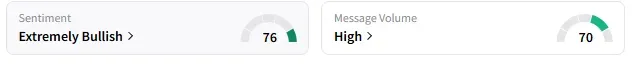

On Stocktwits, retail sentiment around Reddit stayed in ‘extremely bullish’ territory.

A Stocktwits user called the downgrade and the consequent price fall a good chance to buy the stock.

A bearish user expressed skepticism about the company’s business.

Reddit stock has lost over 34% in 2025 and gained 76% in the last 12 months.

Also See: Regeneron To Buy Assets Of 23andMe For $256M: Retail Says ‘Fantastic’ For Future R&D Efforts

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)