Advertisement|Remove ads.

Refiner Valero Energy Tops Q4 Profit Estimates, Retail’s Energized

Valero Energy’s (VLO) shares gained retail attention on Thursday after the company sailed past Wall Street estimates for quarterly profit.

Excluding items, Valero reported adjusted earnings of $0.64 per share for the fourth quarter, compared with the market estimate of $0.06 per share, according to FinChat data.

The stock was up 0.4% in pre-market trade.

It reported quarterly revenue of $30.76 billion, compared with the average analysts’ estimate of $30.02 billion.

Valero’s refining margin during the reported quarter slumped 34.5% to $2.33 billion, hurt by a rise in global refining capacity amid the continued economic downturn in major economies, including China.

Earlier this month, oil majors BP and Exxon Mobil had also flagged weaker earnings in their refining segment.

The company, which owns 15 refineries worldwide, said it processed about 3 million barrels of crude oil daily, the same as last year.

Its fourth-quarter operating earnings from the renewable diesel segment, which consists of the Diamond Green Diesel (DGD) joint venture, rose to $170 million from $84 million, last year.

However, renewable segment sales volumes declined to 3.4 million barrels per day, compared with 3.8 million barrels last year.

The refiner’s Sustainable Aviation Fuel (SAF) project at the DGD Port Arthur plant was completed during the October to December quarter.

“2024 was our best year for personnel and process safety and one of our best years for

environmental performance,” CEO Lane Riggs said in a statement.

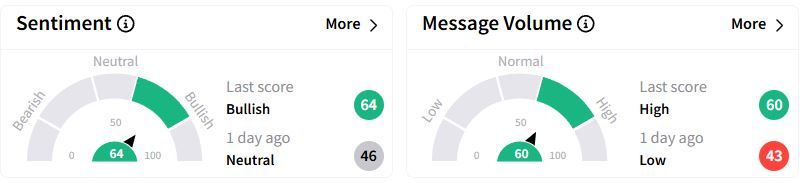

Retail sentiment on Stocktwits rose to ‘bullish’ (64/100) territory from ‘neutral’(46/100) a day ago, while chatter rose to ‘high.’

Peer Phillips 66 is scheduled to report its earnings on Friday.

Over the past six months, Valero shares have fallen 13%.

Also See: Meta Tops Q4 Estimates But Offers Lukewarm Guidance: Retail Gets Euphoria As Capex Ramps Up

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)