Advertisement|Remove ads.

Regeneron To Buy Licensing Rights For China-Developed Investigational Obesity Drug For $2B: Retail Sees Stock Hitting $500

Regeneron Pharmaceuticals, Inc. (REGN) on Monday said that it has entered into a strategic in-licensing agreement with China’s Hansoh Pharmaceuticals Group Company to acquire exclusive clinical development and commercial rights outside of the Chinese Mainland, Hong Kong, and Macau for an obesity drug currently in late-stage testing.

The drug called HS-20094, studied in over 1,000 patients and administered as a weekly subcutaneous injection, has demonstrated promising efficacy and safety clinical data, the company said.

As part of the deal, Regeneron will make an upfront payment of $80 million to Hansoh, with potential additional payments of up to $1.93 billion for achievement of development, regulatory, and sales milestones.

Future potential royalties for global net sales outside of the designated territories would be in the low double digits, Regeneron said.

Separately, the company also announced positive interim data from its ongoing Phase 2 trial investigating novel combinations of Semaglutide and Trevogrumab with or without Garetosmab for the treatment of obesity.

The trial demonstrated that approximately 35% of Semaglutide-induced weight loss was due to loss of lean mass. However, combining Semaglutide, the active ingredient in Novo Nordisk’s weight loss drug Wegovy, with Regeneron’s Trevogrumab with or without Garetosmab helped preserve lean mass while increasing loss of fat mass, the company said.

While the Semaglutide and Trevogrumab combination was generally well-tolerated, the triplet combination of Semaglutide, Trevogrumab, and Garestomab had a substantially higher rate of discontinuations due to tolerability issues and other adverse events, Regeneron said.

Two deaths also occurred in the group of patients who received the triple combination, one due to an undetermined cause in a patient with multiple cardiovascular risk factors and the second due to a cardiac arrest in a person with a history of cardiovascular disease. Regeneron, however, said that it has not identified a causal association between treatment and these events.

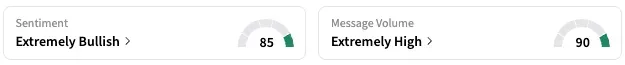

On Stocktwits, retail sentiment around REGN stayed unmoved within the ‘extremely bullish’ territory over the past 24 hours, coupled with ‘extremely high’ message volume.

A Stocktwits user expects the stock to hit $500 on Monday.

According to data from Koyfin, 19 of 25 analysts covering Regeneron rate it a ‘Buy’ or higher, while five rate it a ‘Hold’ and one rates it a ‘Strong Sell’. The stock has an average price target of $763.8.

REGN stock is down by 32% this year and by over 51% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1463539842_jpg_bcfa58ea0b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_stock_jpg_167f2bc3dd.webp)