Advertisement|Remove ads.

Retail Bellwether P&G's Annual Forecast In Focus Ahead Of Q3 Print: Retail Hopes Low

Procter & Gamble Co (PG) will report its fiscal third-quarter results before the market opens on Thursday, and investors will be closely watching any potential changes to its annual forecast and its tariff commentary.

P&G's report, along with PepsiCo’s (PEP), will set the expectations for the packaged consumer goods sector and how they estimate the impact of tariffs.

While companies like P&G, which sell essential everyday products, are generally less affected, higher import duties are still expected to increase input costs and broadly influence consumer spending.

P&G is one of the world's largest consumer goods companies and the sector's bellwether. It sells personal health, hygiene, and home care products under brands such as Pampers, Oral-B, and Gillette.

For Q3, analysts expect sales to drop 0.2% to $20.9 billion, according to Koyfin data.

Adjusted profit is seen rising to $1.53 per share from $1.52 a year ago.

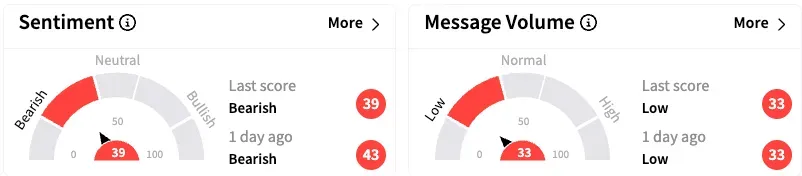

On Stocktwits, the retail sentiment was 'bearish' and message volume 'low', unchanged from the previous day.

On Tuesday, smaller rival Kimberly-Clark (KMB) lowered its annual profit target and warned that tariffs would raise input costs.

In January, P&G maintained its fiscal 2025 view, including the expectations of 2% to 4% sales growth and core earnings between $6.91 and $7.05 per share.

However, at a conference the following month, executives said they might adjust the short-term forecasts due to tariffs. President Donald Trump announced tariff rates only this month.

P&G stock are down 1% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)