Advertisement|Remove ads.

Intel’s New CEO Wins Retail Support – Wall Street Cautiously Optimistic As Stock Sees Pre-Market Gains

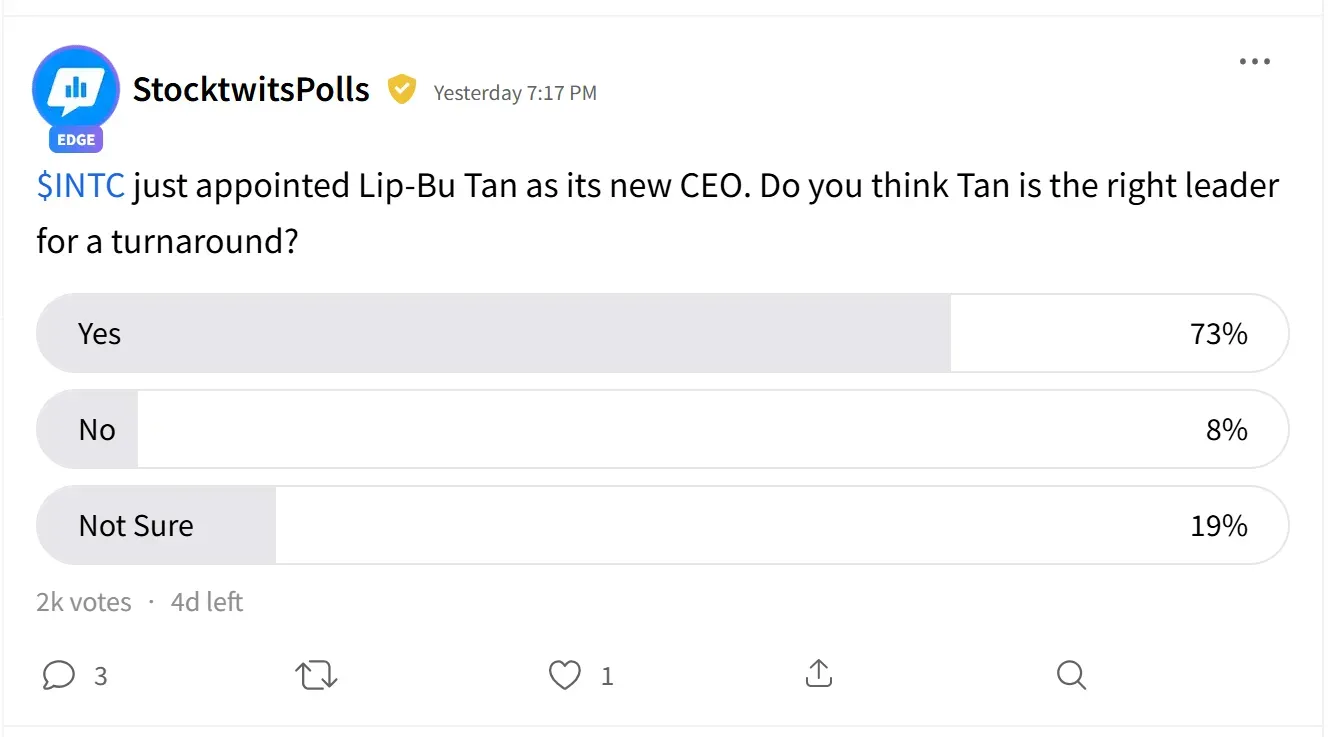

Retail investors are optimistic about Intel’s (INTC) latest leadership shake-up, with 73% of respondents in a Stocktwits poll believing Lip-Bu Tan is the right leader to drive a turnaround.

Intel’s stock was up over 11% in pre-market trade on Thursday.

Tan’s appointment as Intel’s CEO, effective March 18, comes at a critical juncture for the struggling chipmaker as it faces stiff competition from AMD, NVIDIA, and TSMC while grappling with execution challenges in its semiconductor manufacturing strategy.

The leadership change follows the departure of former CEO Pat Gelsinger, who resigned under pressure on Dec. 1, 2024. Gelsinger’s ambitious IDM 2.0 strategy aimed to transform Intel into a major player in contract manufacturing for third-party chip designers.

The board reportedly lost confidence in Gelsinger’s ability to deliver swift progress on his roadmap, leading to his forced exit.

Intel’s new CEO, Tan, brings decades of semiconductor industry expertise to the company, including his role as chairman of Cadence Design Systems and previous service on Intel’s board.

“Together, we will work hard to restore Intel's position as a world-class products company and establish ourselves as a world-class foundry,” Tan wrote in a letter to employees.

Retail sentiment around Tan’s leadership reflects confidence in his ability to navigate Intel through one of its most challenging periods.

However, skepticism persists among some investors. Nineteen percent remain uncertain about Intel’s future under Tan, while 8% believe he may not be the right fit.

Wall Street analysts have taken a measured approach to Intel’s leadership transition, according to reports by TheFly.

Bank of America (BofA) upgraded Intel to ‘Neutral’ from ‘Underperform,’ raising its price target to $25 from $19.

The brokerage cited Tan’s strong track record at Cadence Design Systems, his familiarity with Intel from his prior board tenure, and his broad industry connections as key positives.

However, it balanced this optimism against Intel’s lack of a clear artificial intelligence roadmap and intensified competition in a challenging macro environment.

Stifel also views Tan’s appointment as a "longer-term positive" but maintains a ‘Hold’ rating, citing the lengthy transition period Intel faces as it realigns with the AI-driven market shift.

The brokerage expects AI infrastructure leaders like Nvidia (NVDA) to outperform in the near term.

Morgan Stanley, which holds an ‘Equal Weight’ rating with a $25 price target, acknowledged that Intel’s swift CEO transition was a "good start" but cautioned that significant headwinds remain.

It highlighted Intel’s server market struggles, lack of near-term AI offerings, and over $10 billion in trailing 12-month foundry losses as pressing challenges with "no quick fix."

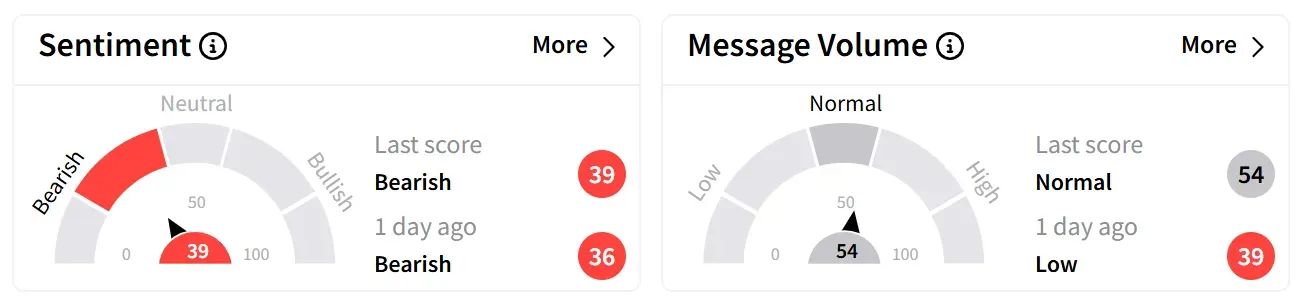

Overall, retail sentiment around Intel’s stock ticked upward but remained in ‘bearish’ territory.

According to platform data, retail chatter around the stock increased by over 200% in the last 24 hours.

Intel’s stock has lost over half its value over the past year but gained 2% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)