Advertisement|Remove ads.

Retail Traders Eagerly Await eToro Market Debut As Stocktwits Follower Count Spikes

Brokerage firm eToro saw a nearly 30% jump in retail watchers over the past 24 hours ahead of its market debut on Wednesday.

The Israel-based company priced its initial public offering at $52 per share, higher than its previous offering range of $46 to $50 per share. Its IPO price gave it a market valuation of $4.2 billion.

The company raised about $310 million after selling 5.96 million shares. Its shares would begin trading on Nasdaq under the ticker symbol "ETOR".

While President Donald Trump’s swearing-in at the White House sparked optimism about fresh IPOs, concerns about tariffs forced several companies, such as eToro and online lender Klarna, to postpone their plans.

Seen as a rival of Robinhood, eToro makes money by charging a fee for transactions, interest on cash balances, and non-trading activities like withdrawals and currency conversion.

The Israel-based company said Goldman Sachs & Co. LLC, Jefferies, UBS Investment Bank, and Citigroup are leading book-running managers for the offering.

In addition, the company also granted the offering's underwriters a 30-day option to buy up to an additional 1.78 million shares.

The company’s net income jumped to $192.4 million in 2024, compared with $15 million a year earlier. It is also pivoting towards crypto, and its revenue from the digital assets jumped to $12 million last year.

Earlier this year, the company signed a partnership agreement with Stocktwits, under which eToro integrated popular content and insights from Stocktwits into the relevant assets pages on the eToro platform. The tie-up also enabled Stocktwits users to trade through eToro directly.

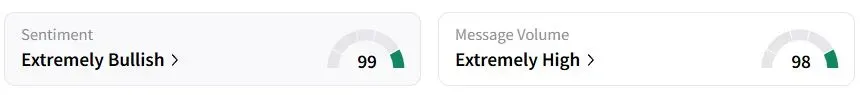

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (99/100) territory, while retail chatter was ‘extremely high.’

One retail trader said if the stock opens at low $50s, “it’s a buy.”

Another user said eToro stock could open at $70+ and will “trade wild” in the first few days.

The company had planned to go public in 2022 through a merger with a blank-check firm, but shelved the plans due to a downturn in U.S. markets amid high interest rates.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)