Advertisement|Remove ads.

Retail Traders Evenly Split About Government Shutdown Odds: Strategists Weigh In On Whether Jobs Report Would Be Delayed Amid Looming Risk

The looming U.S. government shutdown is seen as a significant headline risk for the market, which has been on an extended bull run. An absence of a deal regarding government funding among lawmakers by Sept. 30, when the fiscal year ends, could result in massive layoffs, further complicating the economic outlook.

The standoff concerns a plan for discretionary funding for the upcoming fiscal year. On Sept. 19, a stopgap bill to fund the government through Nov. 21 failed to clear the Senate, where it needed 60 votes, after the Republican-controlled House passed it.

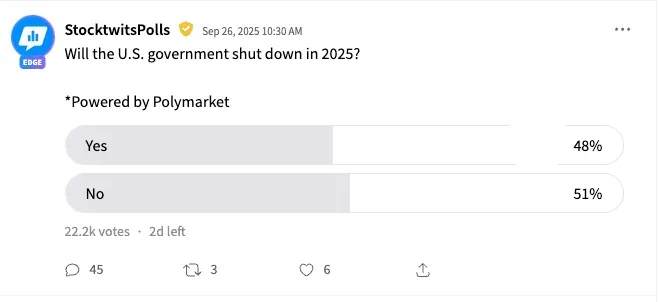

An ongoing Stocktwits poll, in partnership with Polymarket, which asked platform users if the U.S. government would shut down this year, found that opinions were split equally. While 51% of the respondents said it was unlikely, 48% said it was likely to occur.

According to Polymarket, Stocktwits’ predictions market partner, the odds of a government shutdown have decreased to 72% from 80% as of Friday. The improved odds reflected optimism after reports, citing a White House official, stated that President Donald Trump would meet with top lawmakers from both sides of the aisle on Monday to discuss government funding and avert a shutdown. Incidentally, the president cancelled a previous meeting with Rep. Hakeem Jeffries (D-N.Y.) and Sen. Chuck Schumer (D-N.Y.) to discuss the issue.

The main area of contention is the Affordable Care Act tax credit subsidies, which are set to expire by the end of the year. While Democrats are fixated on discussing an extension as part of the negotiations, their Republican counterparts believe there is still time to address the issue.

In his preview of the week ahead, economist Mohamed El-Erian said, “All eyes will be on Washington as the U.S. Congress attempts to iterate toward an agreement to avoid a government shutdown,” adding that much depends on the ongoing negotiations between the Trump Administration and Congressional leaders.

In a joint statement, Democratic leaders Jefferies and Schumer confirmed Monday’s meeting with Trump and expressed their willingness to help resolve the crisis. “We are resolute in our determination to avoid a government shutdown and address the Republican healthcare crisis,” they said.

The stock market has been chugging along nicely despite the multiple headwinds the economy is facing. The major indices trade just shy of their records, with the SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) that tracks the S&P 500 Index, and the Invesco QQQ Trust (QQQ) having risen 14% and 17%, respectively, year-to-date.

On Stocktwits, sentiment toward both ETFs was ‘neutral’ as of early Monday, while the message volume on both streams remained at ‘high’ levels. The iShares U.S. Healthcare ETF (IYH) is down 1% this year.

Economists and market participants are mainly worried about the shutdown as investors close out the month and quarter, according to a MarketWatch report. Charles Schwab investment strategist Kevin Gordon reportedly said, “This one could come at a really unfortunate time because we are supposed to get the jobs report on Friday,” adding that “If we don’t get access to that data, it’s going to be a problem.”

The report also stated that Wells Fargo Global Strategist Gary Schlossberg said, “At the moment, we view the government shutdown on Oct. 1 as a high-probability event, likely lasting long enough to delay release of the September jobs [report] and, likely, CPI releases, due out October 3 and 15, respectively.”

He sees any shutdown now as causing more extensive disruptions to data releases than the partial shutdown that occurred between December 2018 and January 2019 because more agencies are poised to be impacted by the lack of appropriation bills passed by Congress.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tilray_Brands_jpg_add037e8e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wendy_s_resized_jpg_9b298d0aee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)