Advertisement|Remove ads.

Trump Tariffs Spark Risk-Off Mood — Retail Traders Eye Extended SPY Sell-Off

The SPDR S&P 500 ETF Trust (SPY) is down for a third session as President Donald Trump’s tariffs spread panic among investors. Stocks recovered slightly in early morning trading amid rumors that Trump plans to pause the tariffs on all countries except China. With White House reportedly refuting the rumors, the market has reversed course since then.

Retail investors think the sell-off isn’t done yet, even as the SPY exchange-traded fund (ETF) has fallen notably from its Feb. 19 intraday high of $613.23.

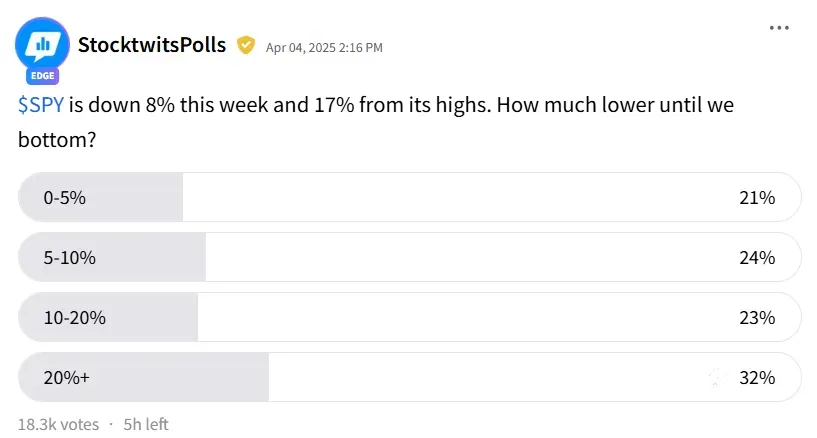

An ongoing Stocktwits poll that collected responses from 18,300 users showed that more than three-fourths of the respondents predict losses of over 5% to more than 20% for the SPY ETF before it hits the bottom.

Most respondents (32%) fear the worst and are bracing for a loss in excess of 20%, while the proportion of respondents expecting a 10-20% pullback is 23%.

A similar proportion (24%) forecast a 5-10% loss; only 21% see a shallow pullback of 0%-5% before the ETF hits the trough.

A user who responded to the poll said the ETF could go as low as its COVID-19 bottom. The SPY bottomed at $218.26 on March 23, 2020, following the pandemic-induced sell-off.

Another user said $400-$410 is within reach, given their expectations that another 10% sell-off is likely this week.

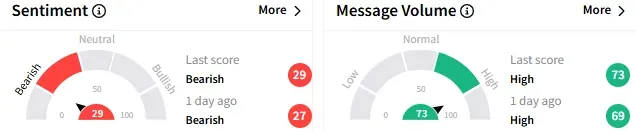

On Stocktwits, retail sentiment toward the SPY ETF remains ‘bearish’ (28/100), while the message volume stayed ‘high.’

Morgan Stanley’s Equity Strategist Michael Wilson said Monday that he is now eyeing the next support closer to the 200-week moving average or the 4,700 level for the S&P 500 Index.

The strategist said, “Valuations also offer better support at that price so investors should be prepared for another 7-8% potential downside from Friday's close if there is no line of sight to a less severe trade environment and the Fed remains firmly on hold.”

Wilson said that, under the current scenario, he would recommend investors to look at high-quality, large-cap, or more defensive equities and indices.

He also predicted small-cap underperformance relative to large-caps, given the former’s higher exposure to macro uncertainty, decelerating earnings per share (EPS) growth estimates, and the tendency to underperform in a late-cycle environment.

The SPY was down about 1.80%, hovering around $496.31at the time of writing. The ETF has declined over 14.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Tariff-Ravaged Reddit Stock Gets Bullish Recommendation On Growth Potential: Retail Sentiment Lags

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210044418_jpg_f521ddb64f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019667_jpg_24c888d76a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_usa_rare_earth_OG_jpg_835f318229.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/02/auto-parts-shutterstock.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/resized_bse_new_image_jpg_62b25f40e1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)