Advertisement|Remove ads.

Retail Traders Give Airtaxi Firm Archer Aviation The Edge Over Rival Joby

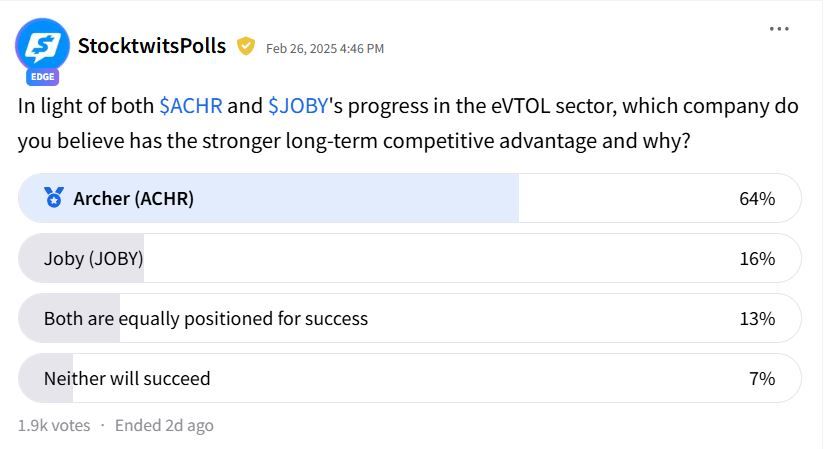

A majority of retail investors said that Archer Aviation has a long-term competitive advantage over its electric vertical take-off and landing (eVTOL) sector peer Joby Aviation.

According to a Stocktwits poll, 64% of the respondents viewed airtaxi firm Archer more favorably than Joby, which got 16% of the votes. While 13% said both companies are similarly positioned for success, 7% said neither would succeed.

In February, Joby said it is targeting "first passenger operations in late 2025 or early 2026" and has made significant progress towards receiving a Federal Aviation Administration (FAA) certification during the fourth quarter.

However, JP Morgan analysts lowered the stock's price target last week to $5 from $6 per share after noting that the company's commercial launch in Dubai risks further delay.

Archer Aviation said last week that Abu Dhabi Aviation, the largest commercial helicopter operator in the Middle East, plans to deploy the first of its Midnight series of aircraft later this year.

One retail investor said that investors are betting Archer’s “quick-start strategy” and focus on regions with friendlier regulations could help them get to market faster. At the same time, Joby is seen taking a “more steady, big-picture approach.”

Another user said Joby would not be able to emerge as the leader among the two companies even if it obtains an FAA certificate first, as it is not required abroad or at the Department of Defense.

Cathie Wood’s Ark Investment Management bought 432,000 shares of Archer last week.

Archer is also developing a hybrid VTOL aircraft for defense applications alongside military equipment maker Anduril.

In February, the company received a certificate from the U.S. Federal Aviation Administration to launch its pilot training academy to train personnel in preparation for its planned commercial air taxi services with its Midnight aircraft.

Over the past year, Archer shares have gained 85% while Joby shares have gained 25.2%.

Also See: UWM Holdings Stock In Spotlight After Keefe Bruyette Upgrade, Retail Stays Enthusiastic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)