Advertisement|Remove ads.

UWM Holdings Stock In Spotlight After Keefe Bruyette Upgrade, Retail Stays Enthusiastic

UWM Holdings (UWMC) stock garnered retail attention after Keefe Bruyette upgraded the stock to “Outperform” from “Underperform.”

According to The Fly, the brokerage also raised the stock’s price target to $7.50 from $6.50. The new price target implies a 19.4% upside to the stock’s last closing price.

The Keefe Bruyette analyst noted that the stock’s 5% selloff following its fourth-quarter earnings was ‘overdone.’

According to FinChat data, the company posted a net income of $0.02 per share for the fourth quarter, compared with Wall Street’s estimated $0.08 per share, in February.

While Federal Reserve rate cuts helped lower mortgage rates in September, they began to rise again towards the end of 2024 on inflation worries.

UWM’s loan originations rose to $38.7 billion during the fourth quarter, from $24.4 billion in the year-ago quarter.

The analyst said that UWM is positioned to be one of the primary beneficiaries of a normalizing mortgage market given its dominant position in the purchase market and increasing share in the refinance market.

As per TheFly, Keefe Bruyette also viewed UWM more favorably than its peer Rocket Companies, which had topped Wall Street’s estimates for quarterly profit last week.

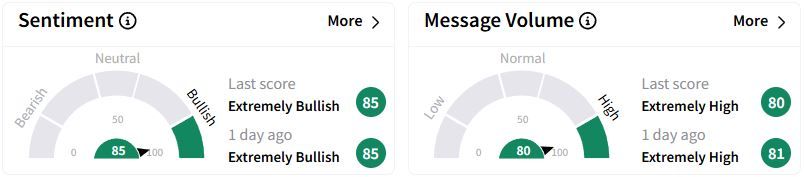

Retail sentiment about UWM on Stocktwits remained in the ‘extremely bullish’ (85/100) territory, while retail chatter remained ‘extremely high.’

According to FinChat data, the stock has a 12 month consensus price target of $6.72.

Last week, another brokerage, BTIG, viewed the selloff as temporary and said it was due to an expense-driven quarterly earnings miss, which is less impactful than a decline in demand.

UWM shares have gained marginally over the past year, but they have fallen by 5.4% over the past three months.

Also See: Shell Reportedly Mulls Chemical Asset Sales In US, Europe — Will It Sway Retail Bears?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_a4b797d3d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)