Advertisement|Remove ads.

Revvity CEO Acknowledges Challenges In Immunodiagnostics Business In China: Retail Terms Stock Drop An ‘Overreaction’

Revvity, Inc. (RVTY) CEO Prahlad Singh acknowledged challenges to the company’s immunodiagnostics business in China, owing to changes in regulations, and warned of a pullback during the firm’s earnings call on Monday.

The CEO stated that the company began experiencing challenges in its diagnostics business midway through the second quarter, due to a revised lab reimbursement policy tied to Diagnosis-Related Groups (DRGs), which affected the size of diagnostic panels ordered by physicians in the country.

Healthcare providers are opting for fewer multiplex diagnostic products, the CEO said, while noting that this trend is likely to drive volume for single-plex tests.

“For the remainder of the year, we are now expecting a fairly meaningful pullback in our immunodiagnostics business in China, which is incorporated into our updated outlook for the total company for the year,” Singh said. The immunodiagnostics business in China represents 6% of the company’s total revenue.

Shares of the company slid 8% as of Monday afternoon, at the time of writing.

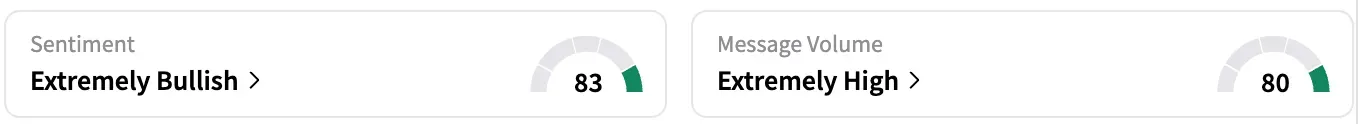

On Stocktwits, retail sentiment around RVTY jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘high’ to ‘extremely high’ levels.

A Stocktwits user opined that the drop in stock on Monday is an overreaction, and that it is being overly punished for a change in Chinese regulation.

Yet another opined that the change in regulation applies to all companies in the space and that the company has sufficient cash on hand.

For the full year 2025, the company has raised its revenue guidance to $2.84 billion to $2.88 billion, reflecting recent changes in foreign currency exchange rates and assuming 2% to 4% organic growth.

The company also updated its adjusted earnings per share guidance to a range of $4.85 to $4.95, down from its previous guidance of $4.90 to $5.

For the second quarter, the company’s revenue came in at $720 million, marking a 4% growth and exceeding an analyst estimate of $711.33 million, according to data from Fiscal AI.

Adjusted earnings per share for the quarter came in at $1.18, compared to $1.22 in the corresponding period of 2024, but above an expected $1.14.

RVTY stock is down by 14% this year and by about 24% over the past 12 months.

Read also: CervoMed Dementia Drug Slows Disease Progression In Study: Retail Loads Up On The Stock

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)